Inflation: Trump criticizes US Federal Reserve for failing to control inflation and outlines strategies to strengthen the economy.

- Inflation: Trump criticized the US Federal Reserve for its ineffective handling of inflation.

- He promises to tackle inflation by focusing on energy production, trade, regulation, and manufacturing.

- Trump expressed concerns about the Fed’s bank regulations after recent financial crises.

- Observers worry that Trump’s comments may affect the Federal Reserve’s independence.

Trump’s Concerns Over Inflation and the Federal Reserve

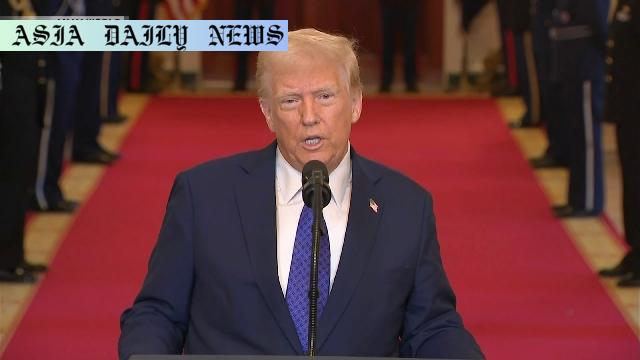

Former US President Donald Trump has voiced strong criticism over how the Federal Reserve, led by Chair Jerome Powell, has managed inflation in recent times. Following the Fed’s decision to hold interest rates steady, Trump took to his social media platform to express discontent, accusing the central bank of failing to effectively address the ongoing inflationary challenges in the US economy.

Unveiling Trump’s Vision for Inflation Control

In his response, Trump outlined his aggressive plan to tackle inflation, declaring that he would “unleash American Energy production, slash Regulation, rebalance International Trade, and reignite American Manufacturing.” His focus on expanding energy production highlights a strategy aimed at offsetting resource costs, while reducing regulatory burdens would aim to stimulate business activities. His remarks further underline a comprehensive agenda to restore fiscal balance and foster industrial growth in the nation.

Criticism Over Bank Regulations

Trump’s critique of the Federal Reserve extends beyond inflation control. He also accused the Fed of poor oversight in bank regulation, referencing the aftermath of the 2023 collapses of Silicon Valley Bank and other financial institutions. These events, which exposed vulnerabilities within the banking sector, prompted much tighter regulatory scrutiny—a move Trump appears to view as excessively stringent.

Potential Risks to Federal Reserve Independence

Observers have raised legitimate concerns regarding Trump’s rhetoric and its potential influence on the Federal Reserve’s traditionally independent operations. Last week, Trump put forward the suggestion that he could request a rate cut if crude oil prices drop—a proposition some experts view as overstepping the bounds between government and monetary policy. Such comments could pressurize the Federal Reserve and blur the critical line that separates federal policies from independent financial institutions.

Context and Broader Economic Impact

Trump’s criticisms come at a time when inflation continues to weigh heavily on American households, with many struggling under the burden of high prices for basic goods and services. His expansive plan to revitalize energy production, streamline regulation, and encourage manufacturing seems calibrated to address these economic pain points. However, critics have questioned whether these measures would deliver immediate relief or risk further financial instability in the short term.

Looking Ahead

As the nation prepares for the next round of presidential elections, Trump’s economic agenda is set to play a significant role in shaping debate around fiscal policy and the Federal Reserve’s role. His remarks have already stirred conversations about the necessity and efficacy of reforms in banking regulation and monetary policy management. How these discussions evolve could influence both voter sentiments and policy directions in the coming months.

Commentary

Analyzing Trump’s Perspective on Inflation Management

Donald Trump’s recent critique of the Federal Reserve reveals his continued focus on economic policies that prioritize aggressive domestic reforms. By targeting inflation and presenting a bold plan involving energy production, manufacturing, and regulatory cuts, Trump aims to position himself as a leader offering solutions to one of the country’s persistent issues. However, his direct criticisms may overshadow the nuances of inflation management, which often requires a balance between monetary policy and external economic factors.

The Risks of Federal Reserve Influence

One of the most concerning aspects of Trump’s comments is the potential for government overreach into the Federal Reserve’s operations. The institution’s independence is a cornerstone of its ability to set monetary policy free from political influence. If Trump’s suggestions find momentum, it could risk undermining the trust and impartiality that the Federal Reserve is known for, leading to increased market instability.

The Broader Takeaway

While Trump’s plan may resonate with voters seeking a quick economic turnaround, it’s vital to approach such strategies with caution. The complex challenges facing the US economy require comprehensive and prudently implemented policies. Trump’s vision underscores a willingness to take bold action, but striking a balance between ambition and practicality will be critical if these ideas are to translate into sustainable economic progress.