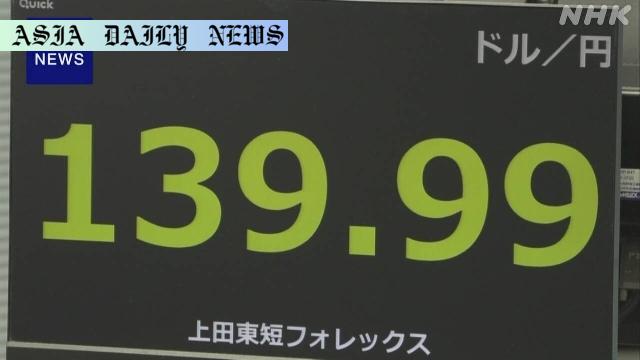

Yen briefly reaches 7-month high at 139 level in Tokyo trading.

Yen surged to a 7-month high at 139 level during Tokyo trading.

President Trump’s push for lower interest rates impacted the dollar.

Speculation mounts over the US Treasury Secretary’s stance on currency.

Yen Strengthens Amid US Dollar Weakness

The Japanese yen reached a remarkable 7-month high against the US dollar, trading at the 139 level briefly in Tokyo on Tuesday. This surge in the yen’s value comes amidst an evolving economic backdrop fueled by US President Donald Trump’s renewed calls for lower interest rates. The president’s statement has led to widespread speculation within the financial markets, prompting investors to steer clear of the dollar and lean towards the yen as a safer alternative. Historically, the yen has been regarded as a stable currency amidst global economic uncertainties, and this latest movement indicates a shift in investor stance towards risk-averse strategies.

In addition to Trump’s push for interest rate reductions, speculation about the position of key policymakers has further influenced the currency markets. US Treasury Secretary Scott Bessent is rumored to favor a weaker dollar, potentially to aid US exports in maintaining competitiveness on the global stage. Market analysts are keenly observing his anticipated meeting with Japanese Finance Minister Kato Katsunobu, who is scheduled to visit Washington later this week. The discussions between the two financial leaders could have substantial ramifications on bilateral economic relations and global currency trends.

Global Economic Implications of a Strengthening Yen

The yen’s latest upward movement could have ripple effects throughout the global economy. Many factors contribute to its current valuation, including doubts about US economic strength and a general shift in market sentiment. A stronger yen tends to impact Japanese exports negatively, as goods from Japan become less competitive due to higher prices in foreign markets. This has long been a point of concern for Japanese policymakers, who aim to strike a balance between a stable domestic economy and international trade dynamics.

On a broader scale, continued declines in the value of the US dollar could disrupt trade and economies of neighboring countries and major trading blocs. Fluctuations in currency values often influence global commodity prices, manufacturing costs, and international investments, illustrating how interconnected and sensitive global markets are to US and Japanese fiscal policies. If these trends persist, the implications for multinational corporations and smaller economies alike will be profound. Economists argue that stabilizing mechanisms, such as coordinated monetary policies among major powers, may be required to mitigate potential adverse effects.

Political Decision-Making and Its Impact on Global Currencies

Currency fluctuations often highlight the intricate relationship between politics and economics. President Trump’s call for interest rate cuts aligns with his broader goal of fostering a conducive environment for US businesses. However, strategic decisions of this nature inherently carry risks of currency weakening, inflation, and imbalances in trade relations. Similarly, the anticipated discussions between Secretary of the Treasury Scott Bessent and Minister Kato Katsunobu underline how government officials wield significant influence over global economic policies.

While Japan could benefit from the yen as a stronger, stable currency for domestic consumption, its export-heavy industries may face challenges if current trends persist. Policymakers in both countries must strike a balance between political goals, economic stability, and global market expectations. International investors and governments alike will closely monitor the outcomes of these high-profile discussions, recognizing that decisions made at these meetings set the tone for future market movements and political alliances worldwide.

Ultimately, the interplay between interest rates, currency valuation, and trade policies underscores the complexities of the modern global economy. Economists and market analysts remain focused on how these decisions unfold and shape economic landscapes in Asia, the US, and beyond.

Commentary

The Importance of Monitoring Currency Trends

The recent surge of the Japanese yen against the dollar sheds light on the ever-fluctuating dynamics of global financial markets. Such currency movements are not merely numbers on a chart but represent broader economic shifts and sentiments that affect individuals, corporations, and entire nations. As the yen reached a 7-month high, it created ripples in international trade discussions, particularly concerning US-Japan relations. The reactions from financial markets around the world underscore the essential role of monitoring these trends regularly.

The Interplay of Politics and Economy

What stands out in this scenario is the direct impact of political decision-making on economic fluctuations. President Trump’s calls for reduced interest rates reflect a deliberate political strategy aimed at fostering domestic economic growth, but such moves do not exist in a vacuum. They influence not only the behavior of the dollar but also how it is perceived against other major currencies like the yen. Similarly, conversations between Scott Bessent and Kato Katsunobu carry the potential to shape broader economic narratives, further entwining political decisions with economic outcomes.

Looking Ahead

As we continue to navigate these turbulent times, it is imperative for policymakers, businesses, and individuals to stay informed and adaptable. The interconnection between global economies ensures that any changes in one corner of the world can reverberate across others. By understanding the forces at play, from interest rates to currency strategies, stakeholders can position themselves advantageously to weather economic shifts and capitalize on emerging opportunities. The strengthening of the yen, while a temporary milestone, serves as a reminder of the constant push-and-pull in the financial ecosystem.