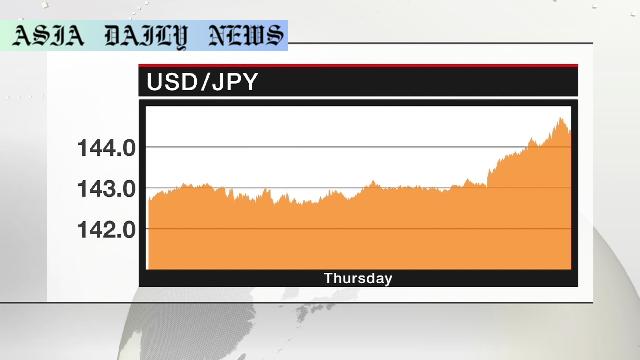

Yen weakens to upper 144 level after BOJ maintains policy stance, pushing Nikkei 225 up, reflecting export-driven optimism in Tokyo.

BOJ decision to maintain monetary policy triggered a fall in the yen.

The yen weakened to the upper 144 level against the dollar.

Nikkei 225 rose by 1.1%, continuing a six-day rally driven by export-related gains.

The Bank of Japan’s Decision and Its Immediate Impact

The Bank of Japan’s (BOJ) decision to maintain its current monetary policy stance has caused substantial ripples in the financial markets, particularly leading to a weakening of the yen against the dollar in Tokyo trading. Analysts and investors alike interpreted the bank’s move as a sign that interest rate hikes would be delayed, prompting speculative decisions to sell off the yen. This decision comes amidst a downgraded outlook for Japan’s economic growth and inflation, further tempering expectations of an imminent policy shift.

As a direct consequence, the Japanese yen briefly dropped to the upper 144 level against the dollar — a stark reflection of market sentiment fixated on a dovish BOJ attitude. Meanwhile, on the equities front, Tokyo’s stock benchmark, the Nikkei 225, saw a 1.1% rise, closing at an impressive 36,452. Much of this gain is attributed to a weaker yen, a factor that typically bolsters the performance of export-oriented companies.

Export-Driven Optimism Strengthens Equity Markets

The depreciation of the yen has buoyed investor enthusiasm for export-focused companies. Given that a weaker yen enhances the competitiveness of Japanese goods in global markets, the consensus among investors is that export-related businesses would see improved revenues and profits. This optimism helped extend the Nikkei 225’s winning streak to six consecutive trading days. Despite broader concerns about economic stability, the stock market appears resilient, with gains underpinned by favorable currency-related dynamics.

However, the performance of the equities market must be weighed against the broader macroeconomic concerns facing Japan. With downgraded economic growth and inflation expectations, the potential long-term outlook remains uncertain, especially for domestic consumption and investment.

Challenges Ahead for the BOJ

Looking ahead, the Bank of Japan faces mounting challenges. On one hand, its decision to stick with a dovish policy is strategically aimed at fostering growth and sustaining inflationary pressures, which have historically been elusive for the Japanese economy. However, this stance also makes Japanese assets less attractive to investors seeking higher yields, thereby placing downward pressure on the yen.

The global economic climate adds further complexity to the BOJ’s predicament. With central banks like the Federal Reserve and the European Central Bank adopting hawkish stances to combat inflation, the interest rate differential between Japan and other global economies continues to widen. This divergence not only exacerbates the yen’s depreciation but also raises concerns about Japan’s ability to attract capital inflows, which are crucial for economic stability.

What Lies Ahead for the Japanese Economy

As the yen continues to experience devaluation, stakeholders are keeping a close watch on how these shifts affect the broader Japanese economy. Exporters might benefit in the short term, but prolonged yen weakness could lead to higher import costs, impacting consumers and eroding purchasing power. Additionally, the BOJ’s downgraded growth and inflation outlook raises questions about its ability to navigate these turbulent waters.

Despite these concerns, some analysts believe that Japan’s strong export fundamentals and the continued push for innovation in fields like technology and automobile manufacturing might serve as counterweights to any adverse effects of currency devaluation. Nevertheless, balancing growth, inflation, and financial stability will be a herculean task for policymakers in the months to come.

Commentary

Understanding the Implications of the BOJ’s Decision

The Bank of Japan’s decision to maintain its monetary policy brings to light the intricate balancing act that central banks must perform to support economic goals. While the move aims to stimulate growth and uphold inflation, its immediate aftershocks, such as the weakening of the yen, underline the complexity of achieving these objectives in a highly interconnected global economy.

The yen’s depreciation to the upper 144 level against the dollar is undoubtedly a concern for some, particularly import-reliant sectors and consumers who could face rising prices. Yet, for exporters, this is an opportunity—an advantage that strengthens their global competitiveness. The positive reaction in the Nikkei 225 index following the BOJ’s announcement illustrates this dichotomy, with investors rallying behind export-oriented firms.

The Broader Macroeconomic Picture

Nevertheless, it’s important to focus not only on the immediate but also the long-term ramifications of such a decision. Japan is at a crossroads where it must navigate between fostering economic growth and retaining currency stability. The BOJ has hinted that interest rate hikes may not be feasible in the near term due to subdued growth and inflation projections. This stance, while understandable, creates a divergence from other major central banks that are aggressively raising interest rates to combat inflation.

This widening policy gap places Japan in a delicate position. A weaker yen could deter foreign investment and create challenges for Japan in importing essential commodities. At the same time, the BOJ’s focus on nurturing growth amidst historically low inflation remains critical for a country that has struggled with deflation for decades.

Final Thoughts

Ultimately, the BOJ’s decision underscores the multi-faceted challenges of managing a national economy in an ever-evolving global landscape. While the weaker yen is currently seen as a boon for exporters and the stock market, its larger implications for consumers and domestic economic stability cannot be overlooked. The onus now lies on Japan’s policymakers to carefully calibrate their actions in a way that supports both short-term gains and long-term stability.

The BOJ’s decision and its ripple effects remind us of the intricate interplay between monetary policy, currency values, and broader economic health—a reminder that decisions taken in boardrooms have wide-ranging consequences for nations and their citizens alike.