US-Vietnam deal sends Nasdaq, S&P 500 soaring while Dow Jones ends slightly lower.

Washington’s trade agreement with Vietnam boosts US markets.

Nasdaq and S&P 500 close at record highs, Dow Jones dips slightly.

Trade optimism struggles in Asia as Japan faces difficulties.

US-Vietnam Trade Deal Sparks Market Optimism

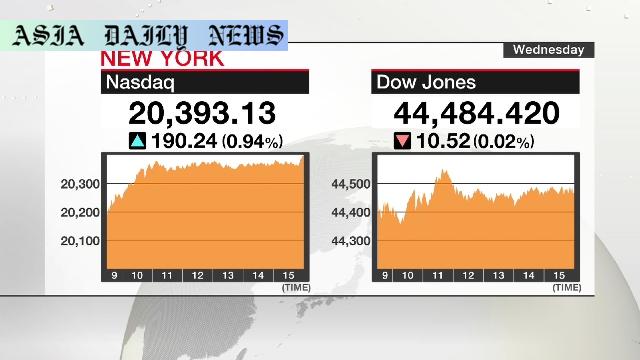

The announcement of a trade agreement between the United States and Vietnam has ignited a wave of optimism across U.S. financial markets. On Wednesday, both the Nasdaq and S&P 500 reached record closing highs, propelled by excitement surrounding potential economic growth driven by international trade agreements. Although the Dow Jones Industrial Average ended slightly lower, key sectors in the Nasdaq and S&P 500 performed exceptionally well, showcasing renewed investor confidence in the stability of U.S. markets.

The trade deal, announced by President Donald Trump, is expected to pave the way for stronger economic ties and collaboration between the two nations, further highlighting Washington’s commitment to enhancing international trade. Investors flocked to a variety of asset classes and industries, demonstrating widespread confidence that the agreement could lead to similar partnerships with other nations in the near future. Some analysts have even speculated that the US-Vietnam partnership could open the door to increased Asian market investments, a strategic move during critical moments in the global economy.

Markets Worldwide React: Mixed Responses in Asia

While the U.S. stock markets celebrated the news, Asia’s reaction painted a more nuanced picture. Japan, a key global player with close economic ties to the United States, experienced difficulties in trade negotiations that weighed heavily on the Nikkei 225 index. Though Tokyo’s market eked out modest gains early on, ongoing uncertainty surrounding Japan’s role in advancing trade deals has suppressed broader market confidence. The situation is further complicated by the strength of the yen, which has made Japanese exports relatively more expensive and, in turn, impacted their global competitiveness. This stark contrast in responses between the U.S. and Japan underscores the dynamic and sometimes volatile nature of global financial ecosystems.

Potential Impacts of the Deal

The broader implications of Washington’s agreement with Vietnam extend beyond immediate market excitement. Not only does the deal signal a strategic pivot for both nations, but it also reignites hope in the global economy’s ability to overcome recent instability. With the American economy benefiting from diversified trade partnerships, corporations and investors are watching closely to see whether this development could mark the beginning of a new phase of trade-related economic growth. However, analysts caution that the long-term impact of the move will depend on several factors, including how quickly both nations implement the agreement and whether geopolitical stability can be maintained.

The Future of U.S. and Global Markets

As global markets continue to digest the news, all eyes are now on Washington and Hanoi to deliver on the promises of this agreement. Investors and market analysts are particularly eager to see if the U.S. administration can replicate this success with other trading partners. With Japan and other nations facing challenges in moving their negotiations forward, the U.S.-Vietnam deal stands out as a beacon of optimism in an otherwise unpredictable economic environment. The strength demonstrated in American financial markets this week could set the stage for future gains, providing other nations follow suit and make strides toward resolving ongoing trade disputes.

Commentary

The Strategic Importance of the US-Vietnam Deal

President Trump’s announcement of a trade agreement with Vietnam represents a significant strategic milestone for both nations. Not only does it signal renewed commitment to fostering international economic collaboration, but it also reflects the growing importance of Southeast Asia as a global economic force. Vietnam, in particular, has become a critical player on the world stage due to its rapid industrialization and increased willingness to engage with major economic powers like the United States. From garments to technology, Vietnam’s role as a manufacturing hub continues to evolve, making this agreement a timely and advantageous development for the U.S.

A Cause for Optimism in Uncertain Times

The market’s enthusiastic reaction to the news underscores the importance of strong, constructive trade agreements. At a time of economic uncertainty due to inflationary pressures and geopolitical tensions, the U.S.-Vietnam deal has offered a much-needed sense of stability and optimism. For investors, this news serves as proof that progress can still be made in rebuilding a more connected global economy. The Nasdaq and S&P 500’s record-setting closings, driven by optimism about the trade agreement, highlight how markets can be buoyed by positive geopolitical developments.

Broader Implications for Global Trade

Looking to the future, the U.S.-Vietnam deal leads one to wonder if similar agreements with other nations could follow. While the hurdles faced by Japan remind us of the complexities involved in striking trade deals, the successful negotiation with Vietnam sets a hopeful precedent. With international cooperation increasingly critical to resolving economic challenges, agreements like this can serve as blueprints for fostering mutually beneficial relationships. Whether this will mark the beginning of a larger trend or remain an isolated success largely depends on the political will and collaborative efforts of both nations moving forward.