US Steel: Trump ensures this storied company stays American.

President Trump announced US Steel will remain an American company.

Nippon Steel invests $14 billion in US Steel, marking a historic moment for Pennsylvania and the steel industry.

Steel tariffs will be increased from 25% to 50%, boosting domestic production.

US Steel’s American Identity Reinforced

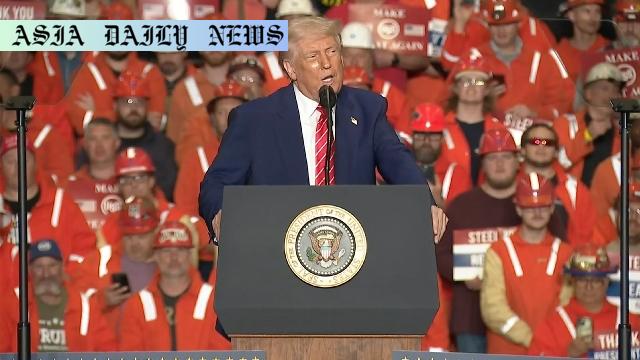

President Donald Trump declared on Friday that US Steel, a pioneer in the steel manufacturing industry, will retain its American ownership following substantial developments in the steel industry. Addressing a rally in Pennsylvania, the President celebrated the decision of Japan’s Nippon Steel to invest a record-breaking $14 billion into the US Steel Corporation. This agreement not only solidifies the company’s role in the American economy but also ensures its roots remain patriotic, marking a pivotal moment for both the company and industrial history.

Trump emphasized the importance of this agreement by calling it a “blockbuster deal” and reiterating its significance for Pennsylvania, a region historically tied to the success of steel production. The investment was described as the largest in both state history and the global steel industry, promising an unprecedented economic boost and job creation in the area. The news closely follows Trump’s announcement to raise tariffs on imported steel to 50%, a move aimed at increasing the competitiveness of American steelmakers on the international stage.

Increased Tariffs Strengthen Domestic Steel Industry

Aside from cementing US Steel’s future as an American-owned company, the announcement to hike steel tariffs is a bold measure that demonstrates the administration’s commitment to protecting domestic industries. The tariff increase from 25% to 50% is likely to curb competition from foreign manufacturers, particularly in regions with lax industrial regulations. This policy indicates an amplified focus on bolstering the nation’s infrastructure and self-reliance in critical sectors like steel production—an industry that serves as the backbone for various sectors, including construction, automotive, and defense.

Trump’s announcement resonates deeply with concerns among Pennsylvania workers and residents who have witnessed the decline of domestic manufacturing jobs over the last few decades. Policies promoting local industrial growth may bring long-term financial stability, not merely to corporations but directly to American families dwelling in manufacturing hubs.

The Significance of $14 Billion Investment

The $14 billion infusion into US Steel represents a watershed moment reflective of optimism in both foreign and domestic markets for revitalizing the American steel industry. With Pennsylvania playing host to this industrial renaissance, the state is forecasted to benefit from an extensive multiplier effect—job opportunities spanning from direct industry employment to auxiliary businesses thriving from increased steel demand. Infrastructure development will also likely accelerate from the resultant spike in steel production, aiding long-term public projects.

As American steel’s economic relevance is restored through these tactical decisions and investments, analysts point to potential ripple effects: renewed innovation in production technologies, competitive exports, and an enhanced role for the U.S. in global commodity markets. The deal exemplifies Japan’s Nippon Steel’s confidence in US Steel’s growth trajectory while reassuring skepticism over international partnerships spiraling into hostile takeovers. Investments at this scale underscore an era of partnerships fostering mutual benefit, collaboration, and the rejuvenation of longstanding industries.

Broader Implications for U.S. Manufacturing

More than just a boost to US Steel, these developments signify broader ramifications for the U.S. manufacturing sector. With steel standing as a bedrock for other industries, sustained investments such as these have far-reaching impacts—bolstering bridges, skyscrapers, and unseen technologies silently requiring tons of steel daily. Increased domestic production serves political interests and patriotic sentiment by reducing dependence on foreign manufacturers frequently associated with inconsistent trade practices and undercutting competitive prices.

Moving forward, balancing protectionist economic measures like Trump’s 50% tariffs with cooperative foreign investments will need to chart a path where flexibility and strength work hand in hand. Nonetheless, optimism remains as America projects leadership through entrepreneurial stewardship, strategic diplomacy, and re-envisioned manufacturing prosperity.

Commentary

Strengthening American Industries

President Trump’s announcement about US Steel remaining an American company and the $14 billion investment from Nippon Steel is undoubtedly a big win for domestic industries. It not only preserves the nation’s industrial heritage but also reinforces America’s economic foundation. This decision, coupled with increased tariffs on imported steel, reflects an assertive stance on protecting and revitalizing American businesses—a sentiment that resonates deeply with many citizens.

Steel has always been a marker of industrial power, and ensuring that production and ownership remain within U.S. borders holds symbolic and practical significance. For decades, declining domestic manufacturing has been a pain point for many communities. This move by Trump seeks to address those pains and foster a resurgence of confidence in American-made products.

Challenges and Opportunities

While many applaud this groundbreaking agreement, it’s essential to recognize the potential challenges it presents. Raising tariffs on imported steel might lead to higher prices initially for industries reliant on steel, such as construction and automotive manufacturing. Companies that import specialty steel products not available domestically could feel the pinch. However, the long-term benefits—job creation, domestic economic growth, and reduced reliance on foreign sources—cannot be understated.

Additionally, the $14 billion investment adds an international dimension to this story. Nippon Steel’s decision to pour capital into a U.S. company highlights the country’s continuing appeal as a destination for secure and worthwhile investments. It is a testament to an evolving partnership where global companies recognize America’s potential as an economic powerhouse.

Future Prospects

Going forward, measures like these could inspire other major companies to re-invest in American soil, particularly in manufacturing-heavy states like Pennsylvania. The emphasis on domestic industrial growth ties closely to national security concerns and economic stability, ensuring that key industries thrive even amid global supply chain uncertainties.

In conclusion, while this decision will likely spark debate among economists and industry stakeholders, it signifies progress for American manufacturing. It is an example of leadership aimed at creating lasting legacies and economic sustainability.