Trump’s Bill: The U.S. Congress has passed President Donald Trump’s controversial domestic policy bill, featuring massive tax cuts.

The Narrow Passage of Trump’s Bill

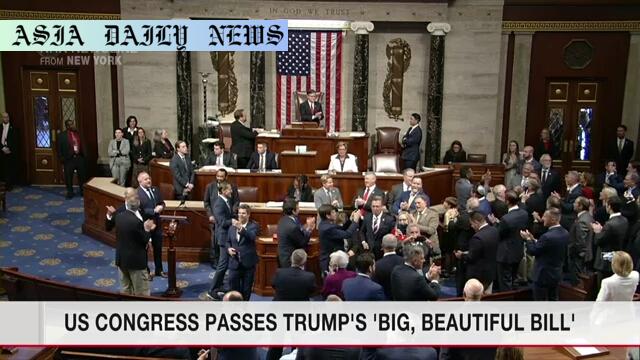

One of the most contentious legislative efforts in recent U.S. history has managed to secure approval from Congress. Trump’s domestic policy bill, colloquially termed by the President as the ‘One Big Beautiful Bill,’ passed narrowly, with a final vote of 218 to 214 in the House of Representatives. Having already cleared the Senate earlier in the week, the bill now awaits the President’s signature to be enacted into law.

This piece of legislation represents a significant victory for the Trump administration’s domestic agenda. A central component is the extension of the President’s first-term tax cuts, rolled out to provide sweeping financial relief to individuals and corporations alike. Furthermore, the inclusion of temporary tax exemptions on tips and overtime pay underscores the administration’s commitment to appealing to working-class voters. Despite its passage, the bill was met with sharp criticism, with Democrats unified in their opposition and concerns raised about its long-term financial implications. Analysts predict a staggering $3 trillion addition to the U.S. debt over the forthcoming decade, raising questions about the bill’s economic sustainability.

Contentious Political Divide

At its core, this legislation has highlighted the deeply entrenched partisan divides that dominate U.S. politics. All but two Republicans voted in favor, underscoring their alignment with the President’s priorities. Democrats, on the other hand, have staunchly opposed the bill. Former President Joe Biden called the legislation ‘cruel,’ emphasizing its disproportionate benefits to billionaires while simultaneously slashing key safety-net programs that serve vulnerable populations. His comments underline progressive concerns about the growing wealth gap in the nation, compounded by fiscal policies aimed at cutting taxes for the wealthy.

The legislation’s razor-thin margin of passage reveals not only deep partisanship but also the eagerness of President Trump to marshal support within his own party. Reports suggest that the U.S. President played an active role in convincing Republicans to stand unified. In a statement, Vice President JD Vance admitted his doubts over whether the ambitious tax reforms would meet Senate deadlines. Nevertheless, as the President keeps his momentum ahead of the Fourth of July holiday, the victory positions this reform as a flagship accomplishment of his administration.

Potential Impacts of Economic Policy

The sweeping tax reforms embodied in the ‘One Big Beautiful Bill’ promise economic relief for some segments of society while potentially exacerbating broader societal challenges. For working Americans, the tax exemptions on tips and overtime pay are likely to serve as a welcome measure. However, economic experts caution against the long-term implications of deferred government revenue.

By slashing several federal safety-net programs, critics argue that the bill disproportionately affects low-income Americans, while offering significant advantages to billionaires and corporations. The Congressional Budget Office’s projection of over $3 trillion in added national debt further raises concerns about the fiscal health of the nation. The substantial debt increase could lead to cuts in critical government services or necessitate tax increases in the future—developments that could negate the temporary financial relief offered.

In the context of historical precedents, it remains unclear whether these ambitious reforms will stimulate economic growth or deepen existing disparities. Policymakers will be monitoring the legislation’s implementation for tangible impacts on job creation, wages, and deficit reduction.

Conclusion

The passage of Trump’s domestic bill represents both a political milestone for his administration and a significant shift in U.S. economic policy. As the nation awaits the President’s signature, analysts and Americans alike debate whether the pros of sweeping tax cuts will outweigh the economic cons of increased debt and reduced welfare protections. Whatever the outcome, this legislation underscores the divisiveness of contemporary U.S. politics and its potential influence on American livelihoods for years to come.

Commentary

The Legacy of Financial Policies

Trump’s ‘One Big Beautiful Bill’ signals much more than a victory for his administration—it illustrates the profound transformation that can occur within national economics when leadership and partisan interests converge. While the historic passage of this legislation will undoubtedly leave an enduring mark, questions linger about who will feel its benefits and who will bear its costs. The sweeping tax cuts and exemptions may provide relief to certain groups, particularly business owners and middle-class workers who rely on tips and overtime. However, such benefits could be offset by the broader challenges associated with ballooning national debt and cuts to essential safety-net programs.

For many Americans, especially those struggling to make ends meet, the bill may feel like a bitter pill packaged as a cure. By slashing federal programs designed to support the country’s most vulnerable citizens, the legislation risks exacerbating income inequality. These challenges are further compounded by the Congressional Budget Office’s projections of a $3 trillion debt increase, suggesting that future taxpayers could feel the consequences of today’s decisions.

Challenges Ahead

Another pressing issue is whether these tax reforms will stimulate the kind of economic growth that they promise. Historically, such measures provide mixed results. Critics argue that similar policies of the past have yielded benefits primarily to wealthier Americans and corporations, rather than fostering widespread prosperity. Whether this bill delivers on Trump’s vision of a revitalized economy remains an open question, and much will depend on its implementation in the coming years.

Nevertheless, the political undertones of the bill’s passage cannot be understated. For Trump and his allies, the razor-thin margin of victory reflects not only a demonstration of political willpower but also the deepening schisms in American politics. The Democrats’ unanimous opposition suggests that reconciliation on fiscal policy may be a challenge too great in today’s polarized climate.

Final Thoughts

Ultimately, the ‘One Big Beautiful Bill’ exemplifies the stakes of contemporary governance. Its passage offers a moment of triumph for Trump and his supporters but raises significant questions about the efficacy of tax reforms in addressing the nation’s most pressing economic challenges. As Americans prepare to celebrate Independence Day, the consequences of this historic legislation—both intended and unintended—will continue to shape the nation’s financial landscape for years to come.