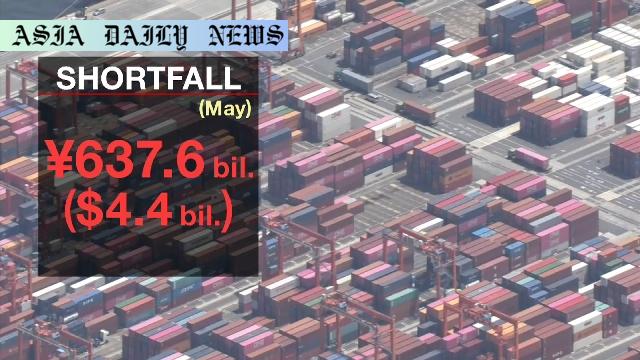

Trade Deficit: Japan reports a 637.6 billion yen deficit in May due to decreased exports to the US and energy price reductions.

Japan’s Trade Deficit: An Overview of May Figures

Japan posted a trade deficit for the second consecutive month in May, with the shortfall amounting to 637.6 billion yen, or approximately 4.4 billion dollars. The drop in exports has been a key contributing factor, with a 1.7% year-on-year decrease. Notably, shipments to the United States plummeted by 11.1%, with vehicle exports declining a significant 24.7%. These declines have raised concerns about the health of Japan’s export-driven economy, especially as global trade uncertainties persist.

While some may speculate about the influence of policies such as the Trump administration’s tariff measures, Japanese Ministry of Finance officials have downplayed their role in the overall trade figures with the US thus far. Instead, the decline seems more closely tied to changing industry dynamics and possibly a reduced demand for specific goods. Coupled with the export decline, imports saw a substantial reduction of 7.7% last month, driven by smaller shipments of crude oil and coal, thanks to lower energy prices globally.

The Broader Impact of Falling Exports

The reduction in exports, particularly to major markets like the US, has significant implications. For Japan, whose economy heavily relies on exportation, an 11.1% drop in shipments to the US signals potential challenges ahead. The automotive industry, represented by the 24.7% downturn in vehicle shipments, deserves particular attention, as it underpins much of the economic ties between the two nations. Vehicles have consistently been one of Japan’s premier exports to the US, and disruptions in this sector could create ripple effects throughout the economy, affecting domestic production, employment, and corporate revenues on a broader scale.

This trade deficit, while a pressing economic concern, provides an impetus for policymakers to explore strategies to safeguard Japan’s economic resilience during volatile times. Exploring ways to diversify Japan’s export markets and industries could be critical to ensuring long-term growth and stability. Furthermore, collaborations with trading partners to address trade barriers or develop new opportunities could assist in counterbalancing the reliance on traditional markets.

Energy Imports Decline Amid Falling Prices

The trade figures from May also highlight a 7.7% dip in imports. This reduction was driven by a combination of falling global energy prices and shrinking inbound shipments of resources like crude oil and coal. The decline in energy imports reflects a broader global trend, where fluctuating price dynamics continually reshape how countries manage their energy dependencies. For Japan, a nation with limited natural resources of its own, shifts in the energy market hold considerable weight over trade balances and overall economic health.

Despite the apparent relief that lower import expenses offer, there remains an underlying challenge of ensuring energy security. Japan must strike a careful balance between leveraging low prices and fostering sustainable energy policies to mitigate potential vulnerabilities. The reduced dependency on high-cost imports also presents an opportune moment to explore alternative energy avenues, such as investments in renewable energy or more efficient energy management systems.

Looking Ahead: Strategies and Resilience

As Japan moves forward, addressing the trade deficit demands a multifaceted approach. In the short term, assessing the key areas of export decline, such as the automotive sector, must be prioritized. Policies aimed at reviving these industries or promoting manufacturing innovation could shore up waning sectors. Long-term strategies should focus on enhancing trade diversification, strengthening relationships with existing partners, and fostering new economic ties globally.

Japan should also capitalize on its technological prowess to lead advancements in alternative industries, ensuring it retains competitiveness on a global stage. Ultimately, the trade dynamics in May underscore the interconnected nature of global markets and highlight the need for swift yet comprehensive responses to economic fluctuations. By prioritizing resilience, Japan can navigate its economic challenges effectively and fortify itself against uncertainties in international trade.

Commentary

Analyzing Japan’s May Trade Deficit

The announcement of a 637.6 billion yen trade deficit by Japan in May has sparked significant conversation and analysis in the economic community. This outcome, largely attributed to a decline in exports coupled with shrinking energy imports, underscores the complexities of Japan’s economic framework. While trade deficits in isolation do not necessarily signify long-term crises, their recurrence over consecutive months does raise concerns about macroeconomic pressures and the nation’s structural vulnerabilities.

Evaluating the Export Challenges

The 11.1% dip in exports to the United States undoubtedly forms the centerpiece of this discussion. Japan’s economic relationship with the United States has always been a cornerstone of its trade policy, and the 24.7% decline in vehicle shipments is particularly problematic given their significance within this relationship. This signals both an immediate challenge for industries reliant on exporting to the US and a broader need to rethink export diversification efforts.

However, it’s worth noting the Ministry of Finance’s comments, emphasizing that US tariff measures have not yet caused widespread disruptions. This dynamic may shift in the future, depending on how global political strategies or economic negotiations evolve. Proactive policymaking should remain at the forefront to deal with such contingencies.

The Role of Energy Dynamics

On the import side, the decline in crude oil and coal prices presents a different narrative. As a country heavily reliant on foreign energy sources, Japan could temporarily benefit from such reductions. However, this also poses a challenge to energy suppliers globally and their ability to sustain export volumes during unfavorable market conditions. The energy sector dynamics could shift again, creating volatility for Japan’s import patterns, which must be navigated carefully.

Overall, Japan’s continued trade deficit challenges prompt serious reflection on strategies for economic sustainability. Effective policy interventions and market adaptability will likely determine the country’s ability to maintain stability and growth amidst global uncertainties.