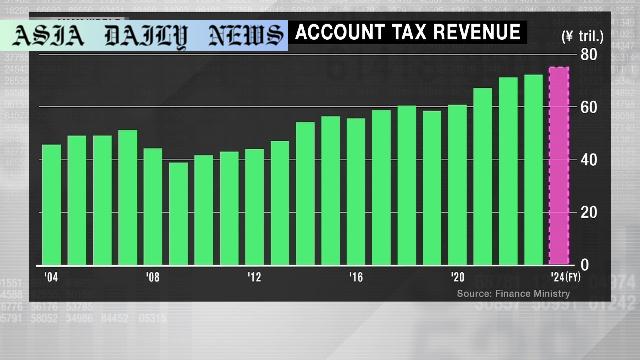

Tax Revenue – Japan’s tax collectors have recorded a historic revenue surge, totaling over 75 trillion yen in fiscal 2024.

Japan achieved record-high tax revenue for the fifth consecutive year.

The total tax revenue for fiscal 2024 exceeded 75 trillion yen.

Key drivers include corporate earnings and inflation-triggered consumption taxes.

Introduction to Japan’s Record-Breaking Tax Revenue

For the fifth year running, Japan has recorded its highest-ever tax revenue, highlighting the country’s economic resilience and ability to capitalize on a dynamic fiscal structure. According to estimates from the Finance Ministry, the total tax revenue for fiscal 2024, which ended in March, surpassed an impressive 75 trillion yen—equivalent to approximately 522 billion USD. This remarkable achievement highlights the importance of aligning policy adjustments with real-time economic developments to maximize national income.

Factors Driving the Revenue Surge

The significant increase in tax revenue has been fueled by two primary factors: healthier corporate bottom lines and increased consumption-tax proceeds, both influenced by inflation. Japan’s businesses have shown resilience and profitability despite global economic uncertainties, providing a substantial boost to corporate tax collections. Additionally, inflation-driven higher prices have increased consumption-tax revenues as individuals spent more, albeit at higher cost levels. The economy’s stability and robust purchasing behaviors have transitioned into fiscal gains.

Comparison with Previous Projections

When the supplementary budget was compiled last November, the Finance Ministry predicted a 73.4 trillion yen total tax revenue. However, the actual income exceeded this by over 1.6 trillion yen, surpassing expectations. This accomplishment reflects a prudent and adaptable fiscal framework, which has allowed Japan to collect more revenue amidst evolving economic conditions. Surpassing previous projections by such a significant margin speaks to the strength of its economic and regulatory policies.

Implications for Japan’s Fiscal Strategy

This record-breaking tax revenue will likely have significant implications for Japan’s fiscal strategies. The increased income allows the government to prioritize debt reduction, infrastructure investments, and welfare programs. Additionally, this trend underlines the potential of inflation-linked taxation strategies to sustain economic resilience. However, a balanced approach must be maintained to ensure that high corporate taxes or consumption taxes do not hinder business growth or burden citizens excessively.

Future Projections and Announcements

The Finance Ministry is expected to release the official results soon, providing detailed data on how the revenue was distributed across corporate taxes, consumption taxes, and other categories. This announcement will likely paint an even clearer picture of Japan’s fiscal health. Looking ahead, authorities might continue leveraging policies that align tax structures with economic indicators to ensure sustained financial stability.

Overall, Japan’s ability to achieve record-high tax revenue for the fifth consecutive year showcases its economic resilience, robust fiscal policies, and adaptive governance mechanisms. With record-breaking income levels, Japan’s government has the resources to tackle pressing challenges and invest in sustainable growth areas.

Commentary

Celebrating Economic Stability and Growth

Japan’s achievement of a record high in tax revenue for the fifth consecutive year deserves not only acknowledgment but also a deeper analysis of the contributing factors. By surpassing 75 trillion yen in fiscal 2024, the nation underscores its ability to foster economic growth even amidst a globally challenging environment. This milestone reflects the interplay between strategic fiscal management and the intrinsic strength of Japan’s economy.

Corporate Growth and Inflationary Trends

The role of corporate profitability cannot be understated in this success. Japanese companies, through resilience and innovation, have managed to thrive despite external pressures like supply chain disruptions and energy price volatility. The secondary but equally important impact of inflation-driven consumption tax also highlights the importance of dynamic and flexible tax systems. While higher prices often strain households, inflation-linked taxation demonstrates the ability to balance fiscal needs with market realities.

Broader Implications for Policy and Society

Such a remarkable surge in tax revenues provides the government with more opportunities to address long-term issues, including public debt, aging infrastructure, and demographic challenges. However, the administration must ensure equitable tax policies to avoid overburdening individuals and small businesses. Maintaining this upward trajectory requires a delicate balance between stimulating economic activity and ensuring fair taxation practices.

In conclusion, Japan’s record-breaking tax revenue for the fifth consecutive year is a reflection of its economic vigor, strategic governance, and adaptability to global trends. As the nation moves forward, maintaining this fiscal momentum will be crucial in meeting its growing economic, social, and environmental responsibilities.