Tariffs increased US customs receipts nearly quadrupled in May from a year earlier to a record $23 billion, says Reuters.

US customs receipts quadrupled to $23 billion in May due to tariffs.

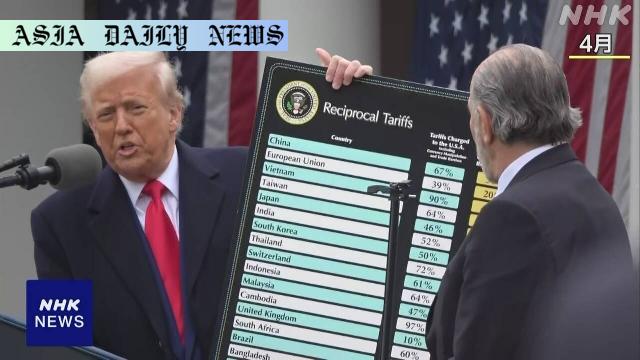

President Trump imposed steep new tariffs on imports globally.

Steel, aluminum, and automotive products were notably targeted.

Treasury data confirms tariffs’ significant revenue impact.

US Customs Revenue Hits Record $23 Billion in May

The United States experienced a significant economic shift in May as customs receipts soared to an unprecedented $23 billion, marking a nearly fourfold increase from the same period the previous year. This remarkable surge was primarily attributed to the tariffs introduced by President Donald Trump on imported goods from numerous global trading partners. According to a report by Reuters, referencing data from the U.S. Treasury Department, these tariffs began to manifest in port-of-entry collections starting April and reached monumental levels by May.

Under the Trump administration’s aggressive trade strategies, tariffs were imposed on a variety of imported goods. Among the most affected were steel, aluminum, and automotive products, which originated from countries and regions including Japan. These measures were introduced as part of the administration’s broader economic policy to encourage domestic manufacturing, support American industries, and address longstanding trade imbalances. However, while tariffs provided an immediate boost to customs revenue, they also raised questions about potential downstream economic consequences, including higher consumer prices, retaliatory tariffs from trading partners, and disruptions to global supply chains.

The Economic Implications of Tariffs

For many, tariffs represent a double-edged sword. On the one hand, as reflected in May’s customs receipts, they bring in substantial short-term revenue for the government. Tariffs essentially function as a tax on imported goods, levied at the point of entry. The increased costs are often passed down the economic chain, starting with importers and eventually reaching consumers. President Trump highlighted this revenue stream as a win for the U.S. economy, citing billions of dollars pouring into the country due to his tariff policies.

On the other hand, critics argue that the macroeconomic impact of such measures could outweigh the benefits. Retaliatory tariffs from trading partners pose challenges to U.S. exporters, which might lose market share in foreign markets. Additionally, industries reliant on global supply chains might face higher production costs, which reduces competitiveness. Economists have debated whether these consequences could dampen the positive aspects of the revenue gains observed in customs collections.

Policy Focus: Tariffs and Economic Strategy

The Trump administration’s economic policy centered around reshaping America’s trade relationships and reducing its trade deficits. Tariffs were positioned as a tool to level the playing field between the U.S. and its trading partners. The emphasis on

Commentary

undefined