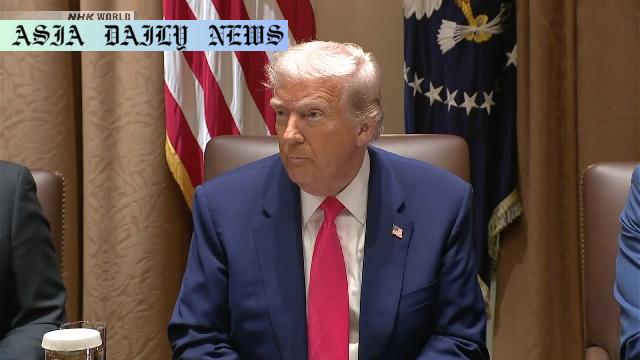

Tariff – US President Donald Trump recommends a 50% tariff on the EU starting June 1, declaring the trade deficit as unacceptable.

Trump’s Recommendation of a 50% Tariff on EU Goods

In a move that has sparked both economic and political discussions globally, US President Donald Trump has announced his recommendation to impose a sweeping 50% tariff on imports from the European Union starting June 1. This bold declaration comes with Trump expressing dissatisfaction over what he characterizes as ‘unacceptable’ trade imbalances between the US and the EU. According to his statement, the US trade deficit with the EU exceeds $250 million annually, a figure he claims is detrimental to American economic interests.

Trump’s announcement generated immediate repercussions within financial markets. European stock exchanges, including benchmark indexes in Frankfurt and Paris, witnessed sharp declines of approximately 3% at one stage on Friday, reflecting investor concerns over the escalating trade tensions. Meanwhile, international policy analysts and trade experts are keenly watching how this proposal might reshape US-Europe economic ties.

Despite criticisms of protectionist policies, Trump seems resolute in pursuing measures that align with his administration’s ‘America First’ agenda. The proposed tariff increase is expected to impact sectors ranging from automobiles and technology to agriculture and luxury goods, potentially creating shifts in global supply chains.

Apple and the Local Manufacturing Requirement

In a related development, President Trump took a direct aim at technology giant Apple. He proposed a 25% tariff on iPhones sold in the US unless the company relocates a significant proportion of its manufacturing from foreign locations like India back to the United States. Trump stated that Apple CEO Tim Cook has already been made aware of this expectation. This move aligns with his broader strategy of encouraging domestic manufacturing and reducing reliance on overseas production.

Apple, on the other hand, appears to have been contemplating such measures for some time. Earlier this month, Cook hinted that iPhones sold in the US might gradually shift to being produced in India as part of their global supply-chain adjustment. However, the president’s demand for domestication adds new pressure on the global tech giant, potentially leading to higher costs and changes in pricing strategies for Apple products.

The broader implications of this policy could ripple across the tech industry, pushing other multinational corporations to reconsider their production plans. It also raises questions about the balance between fostering economic nationalism and maintaining competitive pricing for consumers.

Economic and Global Impact of Trump’s Protections

The impact of these recent tariff announcements will likely extend beyond just the US and the EU. Economists warn of a possible domino effect, with other nations potentially retaliating with similar trade barriers. Such moves could further strain international trade relationships and disrupt supply chains that rely heavily on global cooperation and free trade agreements.

While Trump’s recommendations are designed to boost domestic manufacturing, critics argue that such measures might lead to higher consumer prices and economic instability. Particularly in the EU, sectors like luxury goods, automobiles, and high-tech machinery may face significant headwinds as they lose a substantial share of the US market.

Meanwhile, analysts note the political implications of these announcements. The tariffs could potentially strengthen Trump’s position before domestic audiences who favor protectionist policies. However, it could also incite backlash from affected industries and international trading partners, adding complexity to an already volatile global trade environment.

As the June 1 deadline approaches, the global business community is bracing for the potential fallout. Multinational companies, governments, and trade bodies will likely negotiate intensively to avoid a full-blown trade war that could destabilize an already fragile post-pandemic global economy.

Commentary

The Far-Reaching Implications of Trump’s Tariff Policy

The recent announcements by President Donald Trump regarding a proposed 50% tariff on EU imports and a 25% tariff on Apple products represent significant steps in advancing his administration’s protectionist agenda. These measures have both immediate and long-term implications, not only for businesses but also for international trade relationships and economic stability. Thus, it’s worth diving into the broader perspectives on these developments.

Impact on International Trade Relations

Firstly, the recommendation of such a steep tariff increase will likely exacerbate tensions between the US and the European Union. Trade deficits have long been a sore spot for Trump, and his administration appears convinced that such protectionist measures will force foreign partners to renegotiate trade agreements. However, the unilateral nature of these proposals comes with the risk of retaliation from EU countries, possibly triggering a cycle of escalating tariffs and restrictions.

History shows that such trade wars often create more harm than good. Businesses reliant on imports may face rising costs, while consumers bear the brunt of increased prices. Additionally, the possibility of a fractured global trade environment could inhibit economic recovery efforts at a time when global cooperation is crucial.

Challenges for Apple and Broader Tech Industry

Trump’s direct challenge to Apple regarding local manufacturing also deserves scrutiny. While the intention to boost domestic manufacturing is commendable, such mandates might pose logistical and financial challenges for companies like Apple. Shifting operations to the US requires significant investment in infrastructure and labor, potentially impacting their ability to remain competitive in global markets.

Moreover, the tech industry operates on razor-thin timelines and margins driven by a global supply chain. Forcing companies to reconfigure their operational models at such a pace may lead to unintended consequences—not just for the companies themselves but for their employees, stakeholders, and consumers.

A Balancing Act

It’s essential to acknowledge the rationale behind such policies. Restoring domestic manufacturing and addressing trade deficits are valid objectives. However, pursuing these goals without considering the broader economic and political consequences will likely lead to a myriad of challenges. Policymakers, businesses, and trade bodies must engage in constructive dialogue to ensure that the measures implemented are both effective and equitable.

In conclusion, the proposed tariffs mark a critical juncture in America’s economic policy. Whether these recommendations spark growth or create new challenges for global trade will largely depend on how they are executed and received by global partners. For now, stakeholders must tread carefully, seeking balanced approaches that benefit both domestic interests and the global economy.