Nikkei 225: Tokyo’s stock index hits new annual high for the second day, boosted by Japan-US trade deal and investor optimism.

Nikkei 225 index reached its highest point in a year for the second day in a row.

The index briefly hit the 42,000 mark, reflecting investor optimism.

Growth driven by Japan-US trade deal and anticipated global partnerships.

Broader TOPIX index also closed at an all-time high of 2,977.

Breakthrough for Japan’s Nikkei 225 Index

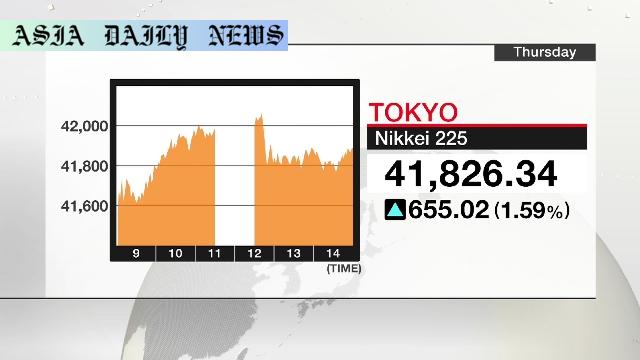

The Nikkei 225, Tokyo’s benchmark stock index, has achieved an impressive milestone by reaching its highest point for the year for the second consecutive day. On Thursday, the index closed at 41,826, marking a 1.6 percent increase compared to the previous day. Notably, the index also briefly reached the 42,000-point mark, a feat last achieved in July during its all-time high. This surge underscores the growing strength of Japan’s equity markets and reflects an optimistic sentiment among investors.

Experts attribute this upswing to the recently signed trade agreement between Japan and the United States, which has sparked hopes for further international economic partnerships. The positive ripple effect of this trade agreement has not only boosted investor confidence but also laid the groundwork for expectations of a new pact between the United States and the European Union.

What Led to This Historic Surge?

The surge in the Nikkei 225 index is fueled by a confluence of factors. Chiefly among them is optimism following the Japan-US trade deal, which has paved the way for further agreements involving Washington and its global allies. As a result, investors have become more active, leading to a surge in demand for stocks across a wide range of industries. This optimism also reflects larger sentiments tied to global economic stability and Japan’s economic resilience.

Not to be overshadowed, the broader TOPIX index similarly reached its all-time high, closing at 2,977 points. The continued rise of both indices underscores the interconnected nature of international trade agreements and their influence on global markets, as well as the central role Japan has played in fostering positive sentiment in the Asia-Pacific region.

Implications of the Market Rise

The rapid acceleration of the Nikkei 225 has far-reaching ramifications for both Japan’s domestic economy and broader global markets. For Japan, the index’s ascent serves as a barometer of financial health and investor confidence. It signals optimism for growth across diverse sectors such as technology, manufacturing, and exports. With many shares picked up immediately after the market opened, the rising interest reflects enthusiasm for Japan’s prospects in the increasingly interconnected global economy.

Looking globally, partnerships between major economies like Japan and the US have had a trickle-down effect, impacting other regions positively. Expectations are already high for the European Union to strike a deal with the US, which may further bolster global trade relations. The upward trend of indices like the Nikkei 225 suggests a renewed belief by investors in stable and cooperative international economic policies.

Challenges and Uncertainties

Despite the buoyant outlook, some challenges remain. Analysts are cautious about how sustainable this growth trajectory might be, given uncertainties in other parts of the global economy such as inflationary pressures, currency fluctuations, and geopolitical tensions. Additionally, while the current trade deal between Japan and the US is encouraging, challenges in securing wider-reaching deals involving multiple international actors could dampen future investor enthusiasm.

Nevertheless, the immediate momentum seen in Japan’s equity markets demonstrates that there are significant opportunities ahead. Should these challenges be navigated effectively, the Nikkei 225 and similar indices may see further historic gains in 2024 and beyond.

Looking Ahead

The resurgence of the Nikkei 225 reflects an increasingly interconnected global economy where trade and cooperation play pivotal roles. With the backdrop of the Japan-US trade agreement fueling expectations for further bilateral and multilateral deals, the outlook for Tokyo’s market remains cautiously optimistic. The developments of this week set a promising precedent for Japan’s economic stability within Asia and its broader role as a significant player in the global financial ecosystem.

Commentary

A Positive Turn for Japan’s Equity Markets

The impressive rise of the Nikkei 225 is undoubtedly a cause for celebration in Japan’s financial circles. Reaching a 42,000-point milestone, the index’s performance is indicative of a strong investor response to a turning point in economic diplomacy between Japan and the United States. Such achievements remind us of the profound role policy decisions play in shaping market trends.

Building Confidence Through Trade Agreements

The role of the recently signed Japan-US trade agreement cannot be understated in this market rally. Bilateral partnerships such as this set the stage for optimism, especially when other trading partners, like the European Union, are anticipated to follow suit. This reflects a fundamental truth that cooperative policies and agreements are at the heart of economic progress in today’s interconnected world.

Remaining Cautiously Optimistic

However, while the current upswing is inspiring, it’s important to tread carefully. Markets are, by nature, subject to fluctuations and influenced by externalities such as geopolitical risks and global inflation concerns. Sustaining this pace of growth will require not just favorable policies but also prudent macroeconomic management.

A Bright Future for Japan and Beyond

Ultimately, the Nikkei 225’s performance is more than a numbers game—it reveals the potential of international collaborations to spark growth and foster optimism. As we look to the future, it’s clear that if Japan continues on this path, it will not just strengthen its role in Asia but also impact the global economy positively. Here’s to hoping that this week marks just the beginning of a stronger, more interconnected global financial system.