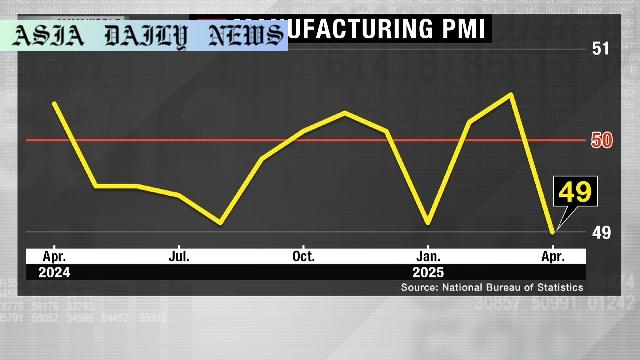

Manufacturing activity dips below 50 as trade war strains businesses, exposing challenges in China’s economic recovery.

China’s April factory activity drops below the 50-line first time in months.

China’s National Bureau of Statistics records a PMI score of 49.

The trade war affects exports and clouds the business outlook.

Manufacturing index below 50 for large, mid-sized, and small firms.

Non-manufacturing sectors also see slowdown, index falls to 50.4.

China’s Manufacturing PMI Drops Below 50: An Alarming Signal

China’s manufacturing sector experienced a notable downturn in April, with the Purchasing Managers’ Index (PMI) slipping below the critical 50-point threshold for the first time in three months. The PMI dropped by 1.5 points from March, reaching 49, signaling contraction. The disruption primarily stems from the escalating trade tensions between China and the United States. This economic standoff has resulted in reciprocal tariff exchanges, adversely affecting exports and industrial confidence.Across all company sizes – large, medium, and small – the PMI remained below the growth threshold, with figures of 49.2, 48.8, and 48.7, respectively. This uniform decline underscores an industry-wide struggle to maintain momentum. Smaller businesses, which often lack the financial resilience of larger organizations, are particularly vulnerable in this environment. The continuous contraction reflects the pervasive challenges faced by stakeholders in the manufacturing ecosystem.

Trade Tensions and Export Challenges

As domestic and international policies collide, China’s export market has been one of the hardest-hit segments. The imposition of tariffs from both Beijing and Washington is making it costlier and less competitive for manufacturers to engage in trade. Within this strained global context, businesses are increasingly cautious about their future investments and production levels. The cautious sentiment is visible as firms recalibrate their strategies amidst uncertainties.Compounding the problem further is the real estate sector’s prolonged slump domestically. Declining property prices and sluggish demand have created additional headwinds, impacting associated manufacturing industries like construction materials, steel, and machinery. The interconnected nature of the economy means that weaknesses in one sector inevitably spill over to others, creating broader economic ramifications.

Government’s Response Amid Economic Strain

In response to these economic headwinds, the Chinese government has pledged to implement reforms designed to invigorate domestic demand. However, the effectiveness of these measures remains uncertain. Reviving sectors like real estate or manufacturing requires long-term policy planning, significant investment, and structural reforms. Current efforts appear insufficient to offset the contraction in international trade caused by geopolitical tensions.The non-manufacturing sectors, which include services, also reported a slight decline in activity, with its index falling to 50.4 in April. Though still above the contraction line, the numbers suggest stagnating growth. Overall, China’s economic trajectory is entering a challenging phase, demanding proactive and innovative solutions. Balancing domestic policies with trade negotiations will be critical to ensure sustainable growth. Future periods may witness intensified debates over diversifying export strategies and reducing dependency on specific trading partners.

Commentary

The Domino Effect of Manufacturing Slowdowns

China’s underwhelming PMI figures paint a vivid picture of the interconnectedness between local policy decisions and global trade dynamics. It showcases how external pressures, such as trade negotiations and tariffs, can ripple across different sectors of an economy. When manufacturing giants like China start reporting contractions, it sends waves affecting not just the domestic economy but global markets as well. This interconnected nature demonstrates the delicate balance required to maintain economic stability in an increasingly globalized world.What stands out from these developments is how smaller manufacturing units are disproportionately impacted. Without the financial buffers available to larger conglomerates, midsized and small-sized firms are often left floundering when faced with sudden downturns or tariff hikes. This is visible in their PMI scores, which dropped slightly lower compared to those from large organizations. Recognizing this disparity must be integral to China’s economic reforms if it wishes to pave the way for equitable industrial growth.

Proactive Measures for a Resilient Economy

It is worth emphasizing the importance of proactive government interventions in countering such economic headwinds. While fiscal measures targeting domestic demand can provide temporary relief, achieving a long-term economic balance requires structural changes. Focusing on improving supply chains, investing in innovation, and widening export bases should be key tenets of China’s strategy moving forward. Furthermore, China’s ability to diversify its trade markets is essential to mitigate risks arising from overly concentrated trading relationships.The slight decline in the service sector also hints at broader structural challenges. While the digital economy and tech-driven services have exploded in many global economies, China may need to accelerate its transition towards these high-value segments. Recognizing the importance of technological adoption and setting policies conducive to innovation will ensure the manufacturing contraction does not have a cascading effect on other crucial economic sectors. The next few months may prove pivotal in defining whether these challenges persist or a new roadmap ensures China remains a strong global economic force.