Land prices surged in Japan as Tokyo commuters and tourists drove demand, with Hakuba village in Nagano recording a 32.4% rise.

Introduction

Japan has recently experienced remarkable growth in land prices, particularly in areas influenced by a surge in inbound tourism and the needs of metropolitan commuters. The combination of natural beauty, cultural allure, and convenient transportation has led to unprecedented demand across several key locations. Regions such as Nagano, Hokkaido, Tokyo, and Gifu are showing dramatic year-on-year increases in property values, reflecting the dual forces of tourism and urban commuting powerhouses.

The Leading Region: Hakuba, Nagano

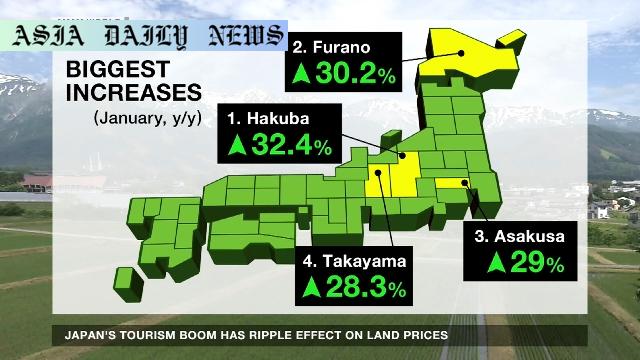

The ski resort village of Hakuba in Nagano Prefecture witnessed the most significant annual increase in land prices, surging by 32.4% as of January 1. This dramatic growth is no surprise given the village’s robust appeal to both domestic and international tourists. Known for its top-notch ski resorts, picturesque landscapes, and year-round recreational activities, Hakuba has long been a preferred destination for snow sports enthusiasts globally. As Japan eases travel restrictions and tourism steadily recovers, places like Hakuba are expected to continue thriving as hotspots for investment and leisure seekers.

Furano City, Hokkaido: A Rising Star

Coming in second, Furano City in Hokkaido posted an impressive 30.2% land price increase. Renowned for its expansive flower fields, local wines, and winter sports facilities, Furano has become a magnet for tourists. Coupled with its serene environment and unique cultural experiences, it offers an ideal balance between natural beauty and accessibility. Its burgeoning popularity has driven both interest and value, positioning Furano as a promising region for long-term investments.

Tourist Appeal in Urban Tokyo: Asakusa and Senju

Tokyo’s Asakusa district in Taito Ward and the Senju area in Adachi Ward have also seen substantial year-on-year increases in land value. Asakusa, with a 29% growth, remains a top destination for visitors drawn to its temples, historical streets, and traditional Japanese experiences. On the other hand, Senju, recording a 26% rise, benefits significantly from its transportation connections to central Tokyo. The accessibility to urban hubs while maintaining a more relaxed suburban feel makes it a prime choice for property investors and commuters alike.

The Broader Implications: Gifu Prefecture’s Takayama City

Ranked fourth with a 28.3% increase, Takayama City in Gifu Prefecture stands out for its historical significance and architectural beauty. It is home to well-preserved Edo-period streets and traditional inns that offer authentic cultural experiences. As domestic and international tourism rebounds, similar historical cities are likely to become more lucrative in driving both real estate interests and local economies.

Conclusion and Future Outlook

Japan’s rising land prices highlight the profound influence of tourism growth and urbanization. As the country positions itself to attract even more visitors in the post-pandemic era, key destinations like Hakuba, Furano, and Tokyo’s bustling districts will likely continue to thrive. The combination of cultural charm, leisure attractions, and urban connectivity creates a potent mix that amplifies real estate demand and raises broader economic prospects. Investors and real estate enthusiasts should keep an eye on these trends as Japan’s property market evolves and expands.

Commentary

Significance of Japan’s Land Price Surge

The recent surge in Japan’s land prices underscores the dynamic intersection of tourism, urban convenience, and real estate investment opportunities. Demand driven by both domestic and international factors suggests not only an economic recovery post-pandemic but also a growing appeal of Japan as a prime destination for tourists and investors alike. With inbound tourist numbers increasing and certain regions experiencing unparalleled growth, this trend serves as a clear indicator of broader development potential.

Tourism: A Key Driver

One of the most striking aspects of this phenomenon is the role of tourism in reshaping regional economies. Areas like Hakuba and Furano exemplify how sustained interest in leisure and recreation can drive significant gains in property value. The greater focus on creating tourist-friendly infrastructure and promoting regional identities has clearly yielded dividends, showcasing the pivotal role of strategic planning in fostering economic growth across Japan’s provinces.

Urban Transformation and Connectivity

Tokyo’s role in facilitating growth also cannot be overlooked. Commuter zones such as Senju in Tokyo’s Adachi Ward illustrate how convenience and accessibility can enhance the desirability of urban peripheries. As individuals prioritize ease of transit and proximity to major hubs, land values in these areas are naturally poised to climb. This shift demonstrates the power of well-connected urban design in shaping property markets and transforming daily urban life.

Forward Perspectives

Looking ahead, these trends indicate a promising outlook for Japan’s property market, with the potential for further growth fueled by ongoing infrastructure improvements and increasing global mobility. The challenge lies in ensuring that this growth remains sustainable and benefits local communities, balancing economic prosperity with cultural and environmental preservation. For international audiences, the Japanese real estate market stands as a prime example of how diverse factors can converge to create robust, long-term growth patterns.