Japanese bond yields rise, reflecting growing investor fears over the nation’s fiscal sustainability and potential financial instability.

Japanese bond yields experienced a near 17-year high, reaching 1.595%.

Investors fear worsening fiscal health due to increased government spending after the July 20 Upper House elections.

Rising long-term yields are impacting everyday financial costs, such as housing and deposit interest.

Introduction: The Surge in Japanese Bond Yields

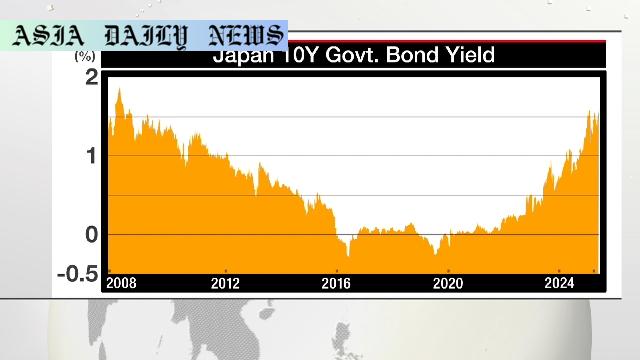

The financial landscape in Japan has experienced a notable shift with the yield on 10-year Japanese Government Bonds (JGBs) climbing to its highest level in nearly 17 years. This increase, reaching 1.595% on Tuesday morning, marks a significant economic event, reflecting investor apprehension toward the nation’s fiscal health and stability. As a general rule in financial markets, bond yields rise when prices fall, and the trend seen in Japan underscores a growing concern about fiscal challenges and an eroding investor confidence.

Understanding the Factors Behind the Yield Increase

Two major factors have contributed to the observed rise in JGB yields. Firstly, the fears surrounding Japan’s fiscal health stem directly from speculation on increased government spending. With the intention to boost the economy, increased fiscal activity usually entails a higher debt burden for the government. Investors have responded by selling off Japanese bonds, causing prices to decrease and yields to rise as a response. The political implications following Japan’s July 20 Upper House elections also sustain these fears as policies around economy-stimulating measures remain unclear.

The Long-Term Economic Implications

Japan’s rising bond yields are also casting a shadow over everyday life by affecting long-term financial instruments like housing loans and deposit interest rates. As long-term yields influence borrowing costs, households and businesses alike may feel the pinch as their financial planning becomes more expensive. Primarily, housing loans could rise, posing challenges to homeowners, while banks might increase deposit interest rates, creating mixed outcomes for savers and spenders. Such impacts underline the interconnected nature of fiscal decisions on national economic health and individual livelihoods.

Comparisons to Historical Trends

The last time Japanese bond yields touched such a level was during the global financial crisis of 2008. Drawing parallels, the current situation fuels concerns that fiscal mismanagement or a rapid escalation in government-driven spending could destabilize the economy long-term. Japan has historically struggled with immense public debt, currently one of the highest among developed nations as a percentage of GDP, and any exacerbation of this might lead to further deterioration of international confidence in the country’s financial stability.

Global Financial Context

International economies facing high inflation and macroeconomic challenges offer a lens to understand Japan’s current situation. While higher government debt financing might offer temporary relief to economic pressures, structural reforms remain a necessity. Investors look for assurances from Japan’s policymakers that any fiscal deficit expansion will be managed effectively to prevent further damage. This dynamic is not unique to Japan, and lessons may be drawn from other nations handling similar balancing acts between stimulating growth and maintaining fiscal prudence.

Conclusion: Seeking a Way Forward

The rise in Japanese bond yields reflects a critical juncture for the nation’s economy, as policymakers must navigate the delicate interplay between fiscal spending, investor confidence, and long-term sustainability. Public and private stakeholders must focus on finding pragmatic and transparent measures to address these concerns. Until a clearer roadmap emerges, uncertainties around Japan’s fiscal health will persist, adding sustained pressure to its financial markets.

Commentary

Impact of Rising Bond Yields on Japan’s Financial Landscape

Japan’s rising bond yields have become a focal point of its economic narrative, bringing to the forefront concerns over fiscal health and policy decisions. It is noteworthy that these developments impact not only high-level macroeconomic dynamics but trickle down to affect everyday financial experiences, including household borrowing and saving behaviors. The ripple effect of financial markets on individual livelihoods cannot be understated.

Political and Policy Implications

The timing of this shift, coinciding with the aftermath of the July 20 Upper House elections, highlights the critical connection between political decisions and market reactions. Investors are often wary of policy ambiguity, especially in times when the economy already shows signs of strain. This situation underscores the importance of clear and decisive governance in navigating fiscal uncertainties.

Addressing Broader Economic Concerns

What stands out most starkly is the risk of stagnation or deteriorating investor sentiment. With Japan’s debt-to-GDP ratio among the highest globally, the nation’s ability to inspire confidence becomes paramount. Engaging in open discussions about debt management strategies, coupled with strong leadership, could be pivotal in mitigating further strain on the economy.

Final Thought

Ultimately, Japan resides at a critical juncture. Addressing investor fears, streamlining fiscal policies, and ensuring transparency in government spending plans are integral components of economic recovery. The current rise in bond yields should serve as a wake-up call, prompting a combined effort among policymakers, businesses, and citizens to restore trust in one of the world’s largest economies.