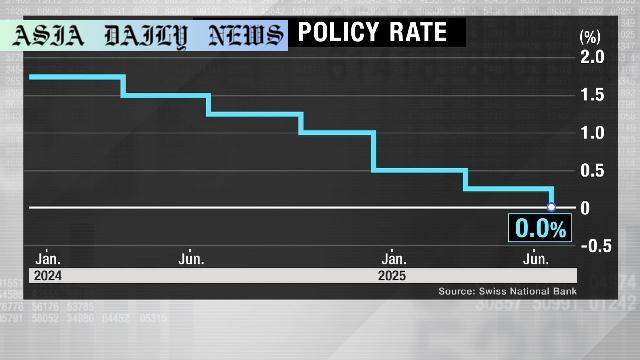

interest rate: Switzerland’s central bank has cut its interest rate to zero as inflationary pressures steadily ease.

Switzerland’s central bank has slashed its interest rate to zero due to declining inflation.

This marks the sixth consecutive cut since March 2024 by the Swiss National Bank.

The policy aims to address economic risks posed by global uncertainties and currency market moves.

Lowering the rate reflects Switzerland’s effort to navigate a fragile global economy.

Introduction

The Swiss National Bank (SNB) has made a decisive policy shift by cutting its interest rate to zero. This historic reduction reflects the easing inflationary pressures that have been developing in Switzerland over recent months. With inflation in May dipping to minus 0.1 percent, this marks a significant milestone as the SNB strives to manage domestic and international economic risks. The central bank’s actions come amidst high global economic uncertainty, influenced by external factors such as international trade tariffs and currency fluctuations.

The Context Behind the Zero Interest Rate

The SNB’s decision to reduce its interest rate to zero is not isolated but the culmination of six consecutive cuts since March 2024. Previously, the policy rate stood at 0.25 percent, and this reduction underscores a consistent effort to alleviate economic challenges. The current figure represents the lowest policy rate since September 2022, underscoring how economic developments have shaped the central bank’s monetary strategies. Switzerland’s unique economic landscape, combined with its stable currency historically acting as a safe haven in turbulent times, has necessitated bold steps to manage inflation and global exposure.

Drivers Behind the Policy Shift

The shift to a zero-interest rate policy has been driven by both domestic and international factors. Domestically, the negative inflation rate in May indicates increasingly favorable price stability. On an international level, the imposition of additional tariffs by the US this year led to significant currency market changes. The Swiss franc appreciated as global investors sought refuge, making Switzerland’s imports cheaper and further easing inflationary pressures. Despite these developments, challenges like global economic uncertainties, persistent geopolitical tensions, and volatile markets remain hurdles for Switzerland’s broader economic health.

Implications and Potential Risks

While the zero-interest rate policy aims to stimulate economic activities and manage inflation, it is not without risks. The global economic outlook remains uncertain, and international developments could pose substantial challenges for Switzerland. Additionally, such a move might inadvertently spark speculative activities in financial markets or lead to potential imbalances in the housing sector. The SNB must carefully monitor both domestic economic indicators and international developments to fine-tune its policies effectively and ensure stability.

The Broader Global Economic Context

The SNB’s decision is emblematic of broader global economic trends as nations grapple with inflation, currency fluctuations, and geopolitical uncertainties. Switzerland’s policy highlights how interconnected economies have become, with local decisions heavily influenced by global circumstances. The central bank’s acknowledgment of these challenges signals a need for cooperative global efforts to navigate collective risks and establish stability in interconnected markets.

Commentary

Insights Into Switzerland’s Zero Interest Rate Policy

The Swiss National Bank’s decision to cut its interest rate to zero is a noteworthy move in today’s global economic climate. Such a bold policy underscores the unique economic circumstances Switzerland finds itself in, with declining inflation and a strengthened currency positioning the country to navigate broader uncertainties. It also reflects the nation’s proactive approach to keep its economy competitive and resilient amidst external pressures.

The Role of Inflation and Currency Stability

The fact that inflation in Switzerland dipped into negative territory is both a testament to strong monetary policies and the country’s economic structure. The Swiss franc’s safe haven status adds complexity to the situation, as external global developments can disproportionately affect Switzerland. Keeping interest rates low might provide short-term relief, but managing longer-term growth and ensuring financial sector health will require careful calibration and vigilance by the SNB.

Global Economic Interconnectedness

This move by the Swiss National Bank also reminds us how intricately connected global economies are. US trade policies influencing Swiss inflation, and the consequent decisions of the National Bank, highlight the ripple effect of economic policies. Switzerland’s ability to adapt to these external shocks is commendable, but it also sets a precedent for other nations to learn from these strategies.

A Cautious Optimism

While Switzerland’s zero-interest rate decision appears to be a well-measured response to domestic and global pressures, it requires a cautiously optimistic outlook. The broader risks of global economic slowdown, trade wars, and geopolitical tensions remain pressing concerns, and the SNB will need to remain agile to adjust policies in the face of changing circumstances. Regardless, the decision demonstrates Switzerland’s commitment to maintaining its economic resilience and its readiness to adapt to emerging challenges.