Federal Reserve holds rates steady amidst economic uncertainty.

Federal Reserve Holds Steady Despite Mounting Pressure

In a significant announcement on Wednesday, the US Federal Reserve stated that it will maintain its current interest rates for the fifth consecutive time, keeping the rates at 4.25 to 4.5 percent. This comes against the backdrop of President Donald Trump’s persistent calls to lower borrowing costs in an effort to stimulate economic activity. Trump, who has been vocal about his dissatisfaction with the Federal Reserve’s cautious stance, claims that failing to act swiftly on rate cuts is adversely impacting the American people and the economy. However, the Fed remains resolute in its mission to address rising inflation and economic uncertainty. During the statement release, policymakers made it clear that they are keeping a close eye on the effects of the ongoing trade tariffs imposed by the Trump administration, signaling a cautious approach to monetary adjustments.

Signs of Division in the Fed’s Decision-Making Committee

What makes this decision noteworthy is the dissent within the rate-setting committee. For the first time since 1993, two governors broke ranks, advocating for rate cuts rather than maintaining the status quo. This division suggests that not all members are aligned in their economic outlook or approach in dealing with prevailing conditions. These internal disagreements could potentially influence future decisions as the Fed seeks to balance economic growth, inflation, and stability. Fed Chair Jerome Powell highlighted during a press conference that while higher tariffs have begun to visibly affect certain goods’ prices, the overall economic and inflationary impacts of these measures remain inconclusive. Powell reiterated that the Federal Reserve is committed to basing decisions on comprehensive data analysis rather than succumbing to political or external pressures, reinforcing the central bank’s independence as an institution.

The Fed’s Stance Amid Economic Uncertainty

The decision to hold rates steady underscores the Federal Reserve’s apprehension about the broader economic outlook. While the US economy continues to demonstrate strengths like a low unemployment rate, inflation remains elevated. Policymakers are also grappling with the potential long-term impacts of global trade wars and domestic policy uncertainties. By maintaining rates, the Fed is essentially buying time to assess how existing policies and external pressures unfold. The move is also indicative of a delicate balancing act—aimed at curbing inflation without stifling economic momentum. Powell, defending the central bank’s cautious approach, reaffirmed the importance of a data-driven method over hasty policy adjustments prompted by external criticism, including the president’s.

Challenges Facing the Federal Reserve

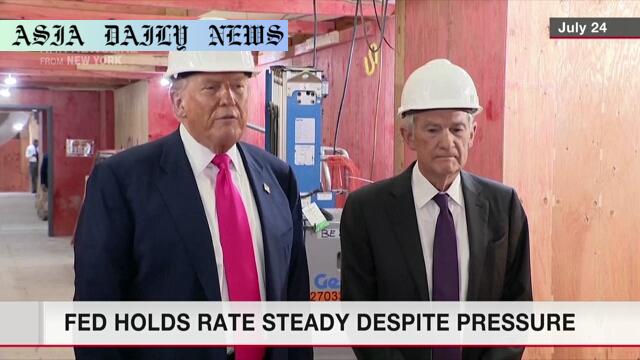

Beyond the economic challenges, the Federal Reserve also faces increasing political scrutiny, particularly from President Trump. In a rare move, Trump even visited the Fed’s headquarters to apply pressure for direct policy changes. Such actions have raised questions about the independence of the Federal Reserve, an institution explicitly designed to function free from political influence. Jerome Powell addressed this during his press conference, emphasizing the critical need for the central bank to maintain its autonomy. The public debate between the presidency and the Federal Reserve could set troubling precedents for the future if politicized pressures grow more intense. Nonetheless, the Fed’s continued commitment to data-centric decision-making is pivotal in mitigating risks to its independence and the economy’s long-term stability.

Commentary

Balancing Independence and Economic Responsibility

The Federal Reserve’s decision to maintain interest rates amid both political pressure and economic uncertainty brings to light several critical themes. First, it highlights the difficult task central banks face in remaining neutral and independent while addressing the concerns of political leaders. Trump’s repeated criticism, although impactful in the public domain, underscores the necessity for the Federal Reserve to keep a firm grip on its independence. This is crucial to ensure monetary decisions are grounded in data and long-term economic health rather than short-term political gains.

The Importance of Strategic Patience

One of the most significant takeaways from this decision is the Federal Reserve’s strategic patience. By holding rates steady despite calls for cuts, the Fed demonstrates a commitment to carefully assessing the consequences of tariffs, inflationary pressures, and a fluctuating economic outlook. In a world where monetary policy directly affects global financial markets, rash decisions can lead to extreme volatility. Allowing time to evaluate the impacts not only ensures stability but also helps build credibility within domestic and international financial markets.

Lessons from the Dissent

The internal division among the Federal Reserve governors is a notable development. While dissent may indicate healthy discussions within the committee, it could also point to growing uncertainty or misalignment in economic strategies. The fact that this is the first significant disagreement since 1993 suggests that governors are facing unparalleled economic challenges. Moving forward, their ability to bridge these divides will likely shape monetary policy and impact public confidence in their leadership.

The Bigger Picture

Finally, the President’s persistent public criticism of Federal Reserve Chair Jerome Powell deserves careful scrutiny. While accountability from elected leaders is essential, overly politicizing an independent central bank poses long-term risks. The Federal Reserve’s ability to operate free from political influence remains one of its cornerstone strengths, ensuring that decisions are made with the broader economy in mind. Any erosion of this independence could lead to far-reaching consequences, not just for the US economy, but for global economic stability as well. It’s vital for public institutions to strike the right balance between accountability, independence, and responsive policymaking, setting an example for governance everywhere.