Factory activity rose slightly, yet concerns persist over trade talks.

Slow, Tepid Growth in China’s Factory Sector

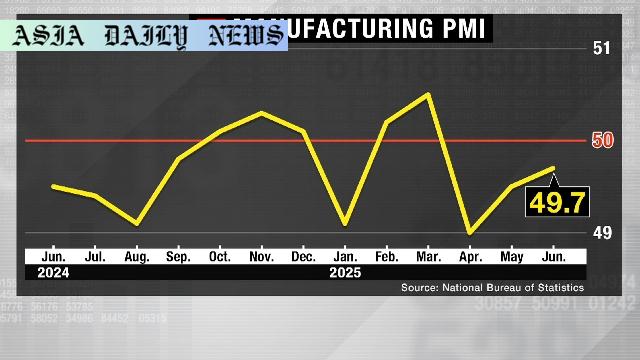

China’s factory activity registered a modest improvement in June, with the manufacturing Purchasing Managers’ Index (PMI) ticking up to 49.7. While this marks a 0.2-point increase from May’s figure of 49.5, the PMI still remains below the critical 50-point threshold. A reading above 50 signifies expansion, whereas any value below indicates contraction. This marks the third consecutive month in which China’s PMI has languished in contractionary territory.

The survey, conducted by the National Bureau of Statistics, involved 3,200 manufacturers across the country. Large businesses demonstrated some resilience, attaining a PMI reading of 51.2—comfortably above the expansion threshold. However, medium- and small-sized firms continued to struggle amidst ongoing challenges in the domestic and international markets.

Uncertainty Casts Shadow Over Trade and Growth

China’s manufacturing sector, a vital pillar of its economy, is under pressure due to global trade uncertainties. The protracted trade tensions with the United States continue to weigh heavily on business confidence. Though recent negotiations and discussions in London have provided a sense of optimism, they have not reversed the prevailing cautious outlook among businesses. Enterprises remain wary of unpredictable tariff hikes, supply chain disruptions, and geopolitical challenges.

Additionally, the index for the non-manufacturing sector, which includes crucial services and retail industries, edged up by 0.2 points to 50.5—barely entering expansion territory. Despite this improvement, sluggish domestic consumption and external demand continue to constrain overall economic growth.

Challenges for Medium and Small Enterprises

While large Chinese enterprises appear to perform comparatively better amidst uncertainties, medium- and small-sized firms are facing significant headwinds. Rising costs, limited access to financing, and reduced demand weigh heavily on smaller enterprises, stalling their recovery. Such struggles highlight the need for targeted policy measures to support vulnerable businesses, especially given their crucial role in employment and the broader economy.

Efforts to stabilize these businesses might include financial incentives, tax reductions, and streamlined administrative processes. Policymakers could aim to ensure a more level playing field for smaller firms, facilitating their recovery and contribution to China’s economic growth.

Lingering Trade Tensions: A Major Concern

The trade dispute between the U.S. and China remains a cornerstone issue affecting the industrial landscape. While conversations between Washington and Beijing have yielded slight reprieves, such as reduced tariffs on certain goods, there is no comprehensive agreement in sight. Prolonged uncertainty further instills caution among business leaders and deters long-term planning and investments. As both nations hold strategic value to the global economy, their trade relations inspire significant attention worldwide.

Confidence can only be restored through meaningful breakthroughs in trade agreements. Until then, China’s growth trajectory faces persistent challenges in breaking free from this volatile period of uncertainty.

Conclusion: The Path Ahead for China’s Economy

China’s factory activity in June paints a picture of an economy battling serious challenges. Despite marginal improvement, substantial hurdles remain—particularly for medium- and small-sized enterprises. The cautious optimism in the non-manufacturing sector offers some reprieve, but broader recovery will depend on the resolution of trade disputes and targeted economic policies.

As China navigates these uncertain waters, adaptability and strategic policymaking will be key to reversing the cautious outlook prevalent among businesses and returning to a path of robust growth.

Commentary

Implications of a Sluggish Factory Activity Recovery

The recent update on China’s factory activity provides both glimmers of hope and reminders of the challenges at hand. A slight uptick in PMI to 49.7 is a positive signal, but it is not enough to allay deeper worries about the state of manufacturing and the broader economy. This sub-50 reading underscores the contraction still gripping the sector. While large enterprises demonstrate their resilience by charting expansionary growth, the struggles of medium and smaller businesses speak volumes about prevailing economic inequalities and structural issues.

Navigating the Trade Talks Dilemma

Trade negotiations between the U.S. and China remain a central theme in understanding the caution permeating the business community. Although recent discussions appear somewhat promising, their inability to instill widespread confidence among manufacturers signals the uphill task ahead. Trade-related uncertainties directly impact production strategies, long-term investments, and supply chain planning. Such challenges require decisive and clear communication between the world’s leading economies, as the ripple effects of their trade spat prompt global repercussions.

The Road to Optimism: Supporting Vulnerable Businesses

Small- and medium-sized enterprises are often branded as engines of job creation, innovation, and regional development. Their ongoing struggles cast a shadow over the efforts to restore robust economic health in China. This situation underlines the urgency to explore targeted support mechanisms—be it in the form of financial incentives, subsidies, training programs, or improved lending terms for struggling companies. Policymakers can foster stability and growth by addressing these structural weaknesses.

In conclusion, while recent developments in China’s factory activity bring cautious positivity, they also highlight significant challenges. A collaborative, multi-faceted approach—encompassing trade resolution and economic reforms—will be instrumental in shaping a sustainable recovery and, ultimately, a brighter economic future for China.