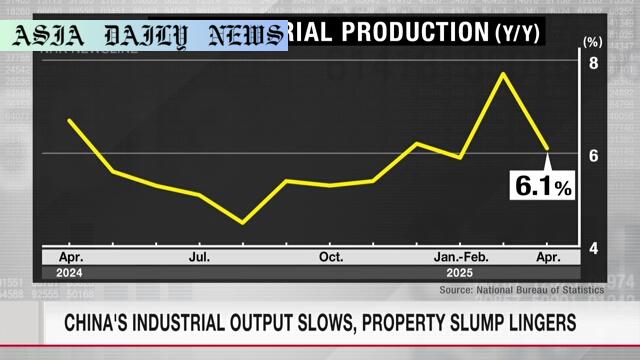

China’s economy: Industrial output slowed to 6.1% growth in April, with continued property downturn and falling real-estate prices.

- China’s industrial output slowed to 6.1% in April, a decline from March’s figures.

- Real-estate investment dropped significantly, with prices of new houses decreasing in nearly two-thirds of major cities.

- US-China trade talks continue amid a 90-day tariff pause, but uncertainties linger about the potential resolution.

Industrial Growth Decline Highlights Economic Pressures

China’s industrial output showcased a significant slowdown this past April, as data from the National Bureau of Statistics indicates a growth rate of just 6.1%. This marks a substantial dip of 1.6 percentage points compared to March, sparking concerns among economists and investors. The slowdown is indicative of broader macroeconomic challenges, including ongoing trade tensions with the United States and structural adjustments within China’s economy. The implementation of additional tariffs by the U.S. has exacerbated these pressures, creating uncertainty for industrial operations and export-driven sectors. Despite efforts between China and the U.S. to reach a mutual reduction in tariff levels in May, the resolution remains fragile, with the potential for renewed tensions persisting.

The Lingering Property Market Slump

The emotional toll of China’s struggling property sector continues to weigh heavily on its broader economic health. Investment in real estate development plummeted by an alarming 10.3% during the first four months of the year compared to the same period in the previous year. Additionally, nearly two-thirds of major cities experienced declines in new home prices, with 45 out of 70 reporting falling valuations—a situation that worsened compared to the previous month. Many economists view this sustained slump as a symptom of deeper structural issues in China’s real-estate policy and speculate that government interventions may become necessary to stabilize the market and restore confidence.

The U.S.-China Trade Negotiation Outlook

Amid these economic challenges, the world watches as China and the United States navigate a crucial phase in their trade negotiations. Both nations have agreed to engage in additional trade talks during a 90-day tariff pause, raising hopes of a resolution. However, the landscape remains precarious, as historical tensions between the two economic powerhouses have proven difficult to overcome. A failure in diplomacy may lead to heightened tariffs, further destabilizing not only the economies of the involved countries but the global markets as well. A durable resolution depends on mutual compromises that address both short-term economic relief and long-term competitiveness on a global scale.

Broader Implications for Global Markets

The slowdown in China’s industrial production and property investment resonates far beyond its borders. As the world’s second-largest economy, China’s performance impacts global trade, from commodity markets to technology sectors. The property slowdown has already influenced commodity demand, particularly in the steel and cement industries, creating ripple effects in exporting nations. Similarly, reduced industrial production growth may signal weaker global demand, compounding economic challenges in interconnected regions. Leaders worldwide will need to monitor these developments closely and brace their economies for potential disruptions stemming from China’s current struggles.

Looking Ahead: The Path to Recovery

While the current economic data highlights significant challenges for China, the nation has proven resilient in navigating similar trials in the past. Policymakers may leverage fiscal and monetary tools to stabilize the economy and restore growth momentum. Additionally, initiatives aimed at diversifying economic activity, reducing dependency on external markets, and revitalizing consumption could pave the way for a more robust recovery. The delicate balancing act of resolving trade disputes, stimulating internal demand, and addressing long-standing structural inefficiencies will ultimately determine China’s trajectory in the coming months.

Commentary

Understanding the Industrial Slowdown

The decline in China’s industrial growth highlights the vulnerabilities of an economy deeply integrated into global trade. The additional U.S. tariffs introduced earlier this year have not only hindered exports but also disrupted supply chains, adding operational costs to various industries. The marginal growth rate of 6.1%—while still reflective of expansion—serves as a stark reminder that the country’s rapid industrial growth trajectory is facing headwinds. This poses questions about sustainability, particularly for industries heavily reliant on international demand. Without implementing robust measures, the nation risks prolonged stagnation in one of its most critical economic sectors.

The Real-Estate Slump as a Symptom of Deeper Problems

China’s real-estate sector has long been a cornerstone of its domestic economy, driving investments and opportunities for millions. However, the continued decline in property investment underscores fundamental cracks in its framework. Overreliance on speculative investments and high levels of debt within the sector have fueled unsustainable growth, leaving the market vulnerable to downturns. The widespread decline in housing prices, meanwhile, chips away at consumer confidence, dampening broader economic recovery efforts. Policymakers will need to adopt innovative solutions that stabilize this vital sector while avoiding pitfalls such as asset bubbles or over-regulation.

Reforming Trade Relations for Future Stability

The trade negotiations between China and the United States are arguably one of the most pivotal events in shaping the future of the global economy. Success in these talks could alleviate tariff burdens and foster renewed collaboration across various industries. However, a mere cessation of hostilities is unlikely to address long-standing issues related to intellectual property and trade imbalances. Both sides must come to the table with genuine intent to build lasting partnerships rather than temporary peace agreements. Achieving this will offer China the breathing room needed to address its internal challenges while also restoring stability to international markets.