Currency stability reassured in US-Japan finance discussions.

The US and Japan reaffirm exchange rates should respond to market dynamics.

No “currency-level targets” were discussed in Washington meeting.

Market stabilization brings temporary relief amid stronger yen concerns.

Japan and US Discuss Market-Driven Currency Stability

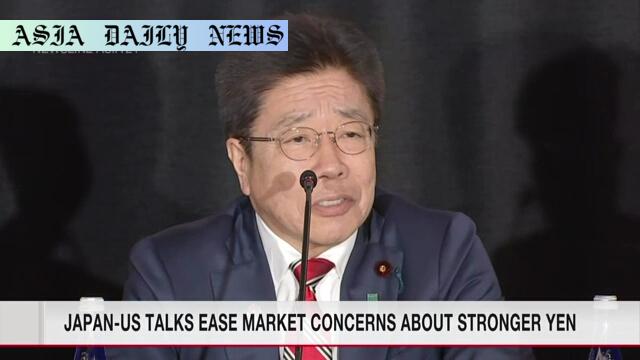

The recent conversation between Japan’s Finance Minister Kato Katsunobu and US Treasury Secretary Scott Bessent demonstrated a collaborative stance on preserving economic stability through market-determined exchange rates. While global attention often spotlights US-Japan relations due to their significant roles in the global economy, this meeting in Washington sought to address rising tensions regarding the yen’s strengthening against the dollar. With growing speculation in recent weeks that the United States would push for adjustments to strengthen the yen, the dialogue clarified several key points for market participants.

The Importance of a Market-Driven Approach

Minister Kato stated explicitly that the United States did not propose or attempt to establish any currency manipulation framework or exchange rate targets. This statement reinforces an important principle shared by both countries: exchange rates should reflect market trends and forces. Such a message, especially during heightened currency scrutiny, assures market stability by deterring interventions. Both Kato and Bessent agreed that improperly managed or excessively volatile foreign exchange markets could disrupt financial and economic equilibrium, a sentiment closely aligned with the broader goals of both nations.

Balancing Concerns Amid Volatility

President Trump’s recent remarks about Japan ‘fighting’ to maintain a low-yen stance sparked debates globally. His concerns aside, the mutual agreements achieved during the Washington meeting demonstrate that diplomatic discourse can help alleviate fears of potential economic shifts. By emphasizing open collaboration and mutual consultation on currency-related matters, both nations underline their aim to balance economic dynamics while respecting global and domestic markets.

The Path Ahead for US-Japan Financial Relationships

As the yen reacted by weakening in Tokyo trading soon after the meeting, investors gained reassurance about the current trajectory of US-Japan currency relations. The calming of immediate concerns no doubt served to remind financial entities of the need for consistent communication channels between such influential economic superpowers. Moving forward, cooperation and implementation of market-driven principles can ensure economic resilience as both countries face future financial uncertainties.

Commentary

Understanding the Diplomatic Impact on Currency Stability

The recent US-Japan meeting highlights the tangible effects of international diplomacy on critical financial matters. Currency exchange rates are among the most scrutinized economic indicators, as they influence everything from trade balances to inflation rates. When two large players in the global financial system engage in open and transparent discussions, their reassurances carry weight beyond immediate markets, offering all global stakeholders a sense of stability.

Market Responses: A Measure of Confidence

The yen’s movement following this meeting reflects more than just trading patterns—it signifies the market’s trust in coordinated efforts to avoid disruption. While President Trump’s comments fueled speculation, the outcomes of this meeting calmed jittery markets, underscoring the importance of mutual collaboration and forethought in economic policy. This moment serves as a lesson on how guarded public commentaries can shape market behaviors in profound, at times unintended, ways.

What lies Ahead for Coordinated Financial Policies

Looking forward, the reaffirmation of principles like market-driven exchange rates and open diplomacy signals hope for sustained financial stability. It remains vital to maintain vigilance, as excessive currency volatility can have ripple effects far beyond nations. Just as this meeting marks progress, it should also inspire ongoing dialogue to foster trust, reduce uncertainty, and find pathways to shared economic prosperity.