Dollar jumps in Tokyo market as Trump backs off Fed firing threats.

Understanding the Dollar’s Surge

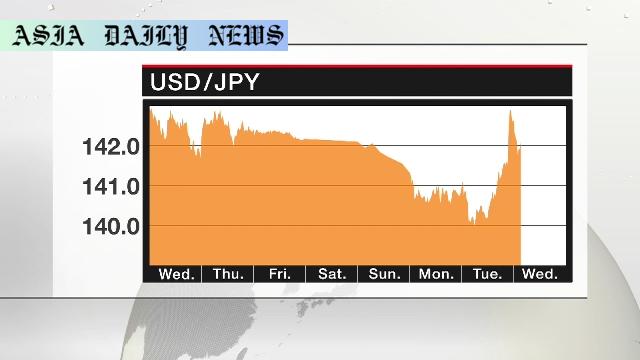

The US dollar saw an impressive rebound against the Japanese yen following a pivotal shift in diplomatic tone by US President Donald Trump. Earlier, concerns loomed as Trump’s sharp criticism of Federal Reserve Chair Jerome Powell stirred fears of turbulence in the Federal Reserve’s autonomous policy oversight. However, in an unexpected development, Trump retracted threats of interfering with Powell’s position, signaling a stabilizing approach to monetary policy. This sudden pivot eased investor apprehensions, which had pressured the dollar down to a seven-month low of 139 yen earlier in the week. On Wednesday, robust dollar buying pushed the currency back to a stable 142-yen level in Tokyo’s foreign exchange market.

Impact on Tokyo’s Financial Markets

Tokyo stock markets reflected the revitalized investor sentiment as the dollar’s recovery coincided with a significant surge in the Nikkei 225 index. Closing 1.9% higher at 34,868 points, the benchmark highlighted renewed optimism among Japanese investors. A major contributing factor was the easing anxiety surrounding US-China trade relations. President Trump expressed a hopeful outlook toward collaboration with China, a key global economic player. This sentiment resonated with the Tokyo exchange, which also benefited from reduced fears about monetary instability in the US. However, market participants remain cautiously observant of ongoing discussions between the US and Japan, particularly concerning the dollar’s strength and its implications for Japan’s corporate earnings.

Lingering Economic Concerns

Despite the upbeat tone from financial markets, longer-term concerns persist. Investors are wary about the ongoing US tariffs affecting Japanese exports and broader corporate earnings. Additionally, this week’s Finance Ministers’ meeting could pivot discussions about the dollar’s valuation against the yen, possibly calling for Japanese policy adjustments. Coupled with the Federal Reserve’s cautious navigation on interest rate adjustments, global financial connectivity remains tenuous. Such dynamics underscore a prolonged period of vigilance among policymakers and investors in the months ahead, with uncertainty threatening financial recovery prospects.

Commentary

The Importance of Trump’s Policy Recalibration

The recent developments around the US dollar and its relative stance to the Japanese yen underscore the critical role of consistent and thoughtful policy communication. By withdrawing incendiary remarks about the Federal Reserve’s leadership, President Trump sent a reassuring signal to global investors. Such attempts are particularly significant in bolstering confidence when financial markets are wary of global trade frictions and monetary policy uncertainties.

Investor Sentiment Shapes Market Dynamics

Markets thrive on clarity, and Trump’s expressed optimism toward US-China relations further reinforces the impact that political rhetoric can have on investor behaviors. Tokyo’s financial markets benefitted immensely as sentiments improved over potentially reduced trade tensions. A recovering dollar, alongside strengthening stock indices, provides an important case study on the interconnected nature of currency valuation and equity performance.

Sustainability Amid Trade Uncertainty

As promising as these latest developments might seem, long-term global financial stability requires structural resolutions. Discussions at the Finance Ministers’ meeting later this week could critically influence the trajectory of USD/JPY valuations and broader monetary policies. Any substantial persistency of US tariffs could detract from Japan’s export-focused industries, affecting their corporate bottom line. As investors and stakeholders, attentiveness to these evolving factors is paramount for continued growth in international markets.