Sentiment: Japan’s major manufacturers see their first drop in sentiment in four quarters, highlighting industry concerns over US tariffs.

The Tankan survey shows Japan’s major manufacturers’ sentiment dropped for the first time in four quarters.

The iron and steel sector experienced a significant decline due to US tariff policies, with a drop of 10 points to minus 18.

Non-manufacturers experienced growth, with the index seeing a 2-point rise to plus 35, boosted by consumption-related industries.

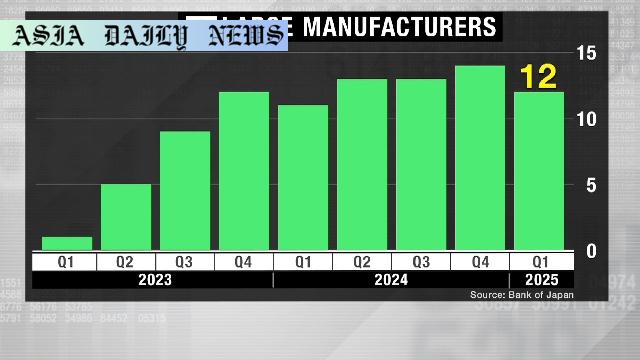

The forward-looking sentiment for major manufacturers remains steady at plus 12, reflecting apprehension about future US tariff impacts.

Introduction: Decline in Business Sentiment Among Japanese Manufacturers

Japan’s business landscape has witnessed a notable shift as major manufacturers report a drop in sentiment for the first time in four quarters. The Bank of Japan’s (BOJ) closely monitored “Tankan” survey, considered a key indicator for gauging the economic outlook, reflects this decline. The business confidence index among major manufacturers dropped by two points, indicating a challenging economic environment influenced by external factors such as fluctuation in demand, global policies, and trade tariffs.

Impact of Tariffs on the Manufacturing Sector

One of the primary reasons behind the decline is the impact of US tariff policies, particularly on sectors like iron and steel. The iron and steel industry saw a dramatic fall in sentiment, with the index plunging by 10 points to minus 18. This reflects growing concerns about the cost of exports and the overall competitiveness of Japanese products in the global market. Industrial stakeholders have expressed wariness over the unpredictability of trade negotiations and their implications for economic stability.

Non-Manufacturing Industries Show Optimism

On the other hand, non-manufacturing sectors provided a silver lining. The business sentiment for large non-manufacturers increased by two points to plus 35. This improvement was led by consumption-driven industries such as retail, which benefited from growing inbound demand. The rise in tourist activities and spending power has been a key factor bolstering consumer-driven sectors, enabling them to navigate economic uncertainties better than their manufacturing counterparts.

Looking Ahead: Concerns on the Horizon

While optimism persists in certain sectors, apprehension about the future remains pervasive. The forward-looking sentiment for manufacturers remains at plus 12, unchanged from the current quarter, indicating a cautious and uncertain outlook. Experts attribute this stagnation to trade tensions, particularly those affecting vehicle-related industries, which continue to face potential repercussions from fluctuating US policies. Non-manufacturers, too, are expected to witness a decline in sentiment, with projections showing a drop of seven points.

Conclusion: Navigating Uncertain Times

The BOJ’s Tankan survey highlights the fragility of current economic conditions for Japan’s industries. As manufacturers grapple with external challenges and non-manufacturing sectors attempt to capitalize on consumption trends, a balanced and strategic approach is needed. Policymakers, businesses, and stakeholders must collaborate to address these hurdles while ensuring the long-term resilience of Japan’s economy. With another 9,000 companies set to be re-surveyed in the coming months, the world will eagerly watch for signs of recovery or further decline.

Commentary

Repercussions of Tariff Policies on Japanese Manufacturing

The recent dip in Japan’s major manufacturers’ sentiment is a stark reminder of how closely intertwined global economic policies are with local business confidence. The Trump administration’s tariff policies, particularly those targeting industries like steel and automobiles, have created ripples worldwide. For Japan, known for its industrial prowess, these tariffs are not just a financial burden but also a psychological one, as manufacturers worry about diminishing global competitiveness.

Contrasting Strength Among Non-Manufacturers

On a more positive note, the rise in business sentiment among non-manufacturers provides some solace amidst the turmoil. The two-point increase reflects how consumer-focused industries, including retail and tourism, are adapting better to the evolving economic scenario. This divergence between manufacturing and non-manufacturing sectors highlights the importance of diversified economic drivers. However, reliance on inbound demand is not without risks, as global travel and consumption trends can shift rapidly.

What Lies Ahead for Japan’s Economy

As global economies shift their strategies amidst ongoing trade tensions, Japan faces a pivotal moment. Policymakers must address external and internal challenges, including fostering innovation in manufacturing and expanding support for services and consumption-driven industries. Tariff negotiations with the US and other trade partners will also play a crucial role in shaping Japan’s economic landscape in the coming years. Adaptive measures are critical for sustaining growth and confidence within Japan’s business ecosystem.