Tariffs: US to impose 25% on steel and aluminum imports effective Wednesday, aiming to counter international trade disparities.

The US will impose 25% tariffs on steel and aluminum imports effective April 2.

Plans for reciprocal tariffs on Canadian lumber and dairy products are underway.

The Trump administration aims to counter trade imbalances and boost American manufacturing.

Tough Tariff Measures to Protect US Steel and Aluminum Industries

The United States is set to enforce a 25% tariff on steel and aluminum imports starting Wednesday, April 2. This pivotal economic policy decision aligns with President Donald Trump’s stated goal of defending American industries and balancing trade inequalities. By imposing significant duties on these materials, the Trump administration aims to reposition the United States as a dominant player in the global manufacturing landscape while addressing competition from foreign markets that it deems unfair.

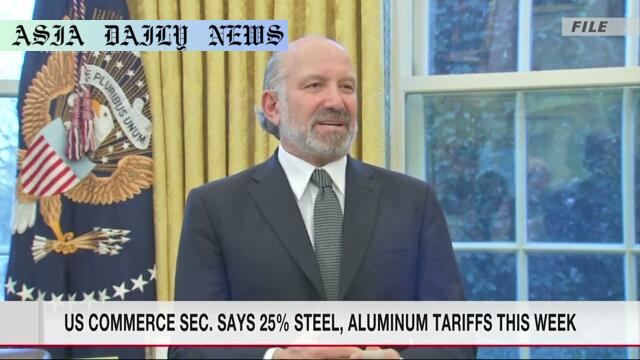

Commerce Secretary Howard Lutnick shed light on this decision in a recent interview, emphasizing its strategic importance to American economic growth. Although the move has sparked heated debate internationally and domestically, supporters argue that it is a necessary measure to reinvigorate domestic production. Steel and aluminum, critical components for industries ranging from construction to automotive, have long been at the heart of the United States’ industrial base. The tariff policy underlines the determination to ensure these industries are shielded from what the administration calls predatory pricing practices by foreign governments and corporations.

Reciprocal Duties Targeting Canadian Products

In addition to the steel and aluminum tariffs, the Trump administration is preparing to impose reciprocal tariffs on Canadian lumber and dairy products. These countermeasures are in response to duties already levied by Ottawa on American counterparts. President Trump, labeling Canadian restrictions as ‘outrageous,’ plans to match those rates to protect American exporters and balance what he considers unfair trade practices. This initiative underscores the administration’s broader commitment to strengthening the United States’ negotiating leverage in international trade agreements and rectifying perceived disparities.

The reciprocal tariffs are expected to take effect shortly after the steel and aluminum tariffs, initiating another surge of economic changes. Key industries, including agriculture and construction, are closely monitoring these measures, which could lead to shifts in pricing and supply chains. While critics express concern about retaliatory measures and potential trade wars, proponents maintain that these adjustments will set the stage for fairer trade rules in the long run.

Reviving American Manufacturing as a Core Objective

Central to this sweeping tariff policy is the administration’s ambition to revitalize domestic manufacturing and reduce reliance on foreign imports. Howard Lutnick defended these measures during his interview, asserting that higher tariffs would make foreign products more expensive and incentivize the purchase of American-made alternatives. According to Lutnick, this shift could result in more competitive pricing for U.S. products, stimulating growth in key industries and potentially creating new job opportunities across the nation.

However, such optimistic projections are met with skepticism by analysts, who warn of potential unintended consequences. They point out that higher import duties could increase costs for U.S. businesses reliant on steel and aluminum, potentially leading to higher consumer prices. The impact of these economic ripples on growth, employment, and inflation will be closely scrutinized as the policies take effect. Nonetheless, the administration’s unwavering focus on ‘bringing manufacturing back’ resonates strongly with its supporters and aligns with the president’s broader ‘America First’ agenda.

Global and Domestic Reactions

The decision to enact these tariffs has not gone unnoticed in the global trade environment. Several trade partners, including Canada and members of the European Union, have expressed their concerns, warning against the potential escalation of a trade war. Domestically, reactions have been equally divided, with industry leaders and policymakers debating the merits and drawbacks of such aggressive trade policies. While some see an opportunity to rebuild critical industries, others warn of the risks associated with retaliatory measures that could potentially harm American exporters.

As this policy unfolds, it remains a topic of intense discussion and prediction. International negotiations to counterbalance these decisions could arise, potentially introducing a new era of trade agreements. For now, eyes are on the administration as it seeks to implement a transformative economic strategy aimed at reshaping both domestic and international trade landscapes.

Commentary

Analyzing the Impact of the Tariff Decision

The implementation of a 25% tariff on steel and aluminum represents a bold but contentious move in the ongoing narrative of U.S. economic policy. Advocates of the measure argue that it is a necessary action to protect American industries from unfair competition and to restore the country’s manufacturing prowess. On the other hand, critics worry about its potential to disrupt existing trade relationships and increase domestic production costs, potentially burdening consumers in the long term.

Strategic Calculations and Risks

President Trump’s tariff policy can be viewed as a calculated strategy to address long-standing trade imbalances. By tilting the scales, the administration aims to bring manufacturing jobs back to U.S. soil—a goal that resonates strongly with middle-class Americans and working families who have felt the adverse effects of globalization. However, the repercussions of such an aggressive approach are unpredictable. Retaliatory measures from trading partners could diminish export opportunities for U.S. industries, including agriculture, further straining trade dynamics.

The Path Forward for U.S. International Trade

Looking ahead, the success or failure of this policy hinges on the delicate balance between protecting domestic industries and maintaining healthy trade relationships. If the administration can leverage these tariffs to secure more favorable trade agreements, the economic benefits could outweigh the risks. However, if tensions escalate unchecked, the global economy may experience significant disruptions, and the U.S. could face long-term repercussions. The coming months will reveal whether these bold measures achieve their intended transformative effect or provoke a period of greater instability in international trade.