Federal Reserve’s cautious stance on interest rates sparks call for thorough institutional examination.

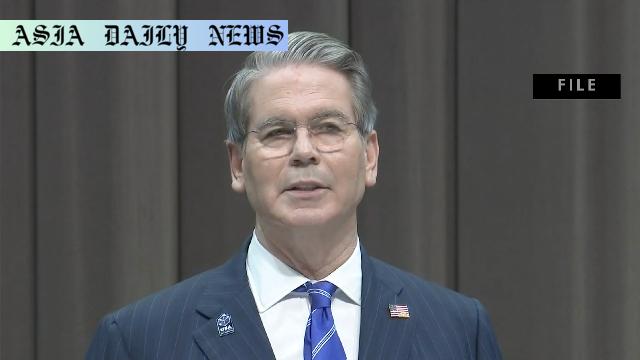

US Treasury Secretary calls for examining Federal Reserve’s policies.

Fed’s cautious approach on interest rates draws criticism.

Rare suggestion of government involvement in Fed’s functions sparks debate.

Introduction: Fed Policies Under Scrutiny

US Treasury Secretary Scott Bessent has called for an extensive review of the Federal Reserve’s (Fed) role and efficacy as an institution. Bessent’s remarks fuel intensified public discourse over the Fed’s cautious approach to interest rates under Fed Chair Jerome Powell. While the central bank prides itself on independence from governmental intervention, such unprecedented statements raise critical questions regarding the boundaries of this autonomy and its implications for the nation’s economy.

A Rare Call To Examine The Federal Reserve

The Fed operates as an independent entity charged with ensuring financial stability, managing inflation, and fostering maximum employment. Historically, political intervention in its decisions has been considered taboo, emphasizing the unbiased nature of monetary policy. However, Bessent’s comments advocating for institutional review indicate dissatisfaction with the effectiveness of Fed policies. This includes critiques of both present and previous monetary strategies, which have been criticized for either losing pacing with economic challenges or adhering too rigidly to traditional molds.

Such statements highlight a potential systemic issue—whether the Fed, bound by institutional norms, is equipped to adapt to modern, volatile global economic landscapes. Critics point towards its conservative stance on interest rates even amid robust inflation metrics, as Bessent hinted, suggesting these delays may hamper economic momentum. While it may seem a measure of prudence, such hesitancy also risks feeding parallel conflicts related to trade policies and global economic competition.

The Fed’s Relationship With The Trump Administration

The notion of examining the Federal Reserve as a whole appears rooted in recent conflicts between the Trump administration and current Fed leadership. Trump’s trade wars and associated tariff policies have been topics of polarizing opinions. While the administration underscores negligible inflationary effects due to tariffs, critics argue the economic picture painted is skewed by temporarily favorable metrics. Along these lines, Bessent implied belief in the administration’s optimistic stance, linking tariff-induced consumer prices with underwhelming Fed intervention on interest rates.

Interestingly, it appears that President Trump’s economic agenda diverges significantly from Powell-era principles, which err on the side of caution in rate adjustment—a divergence that places the Fed under political crosshairs. Bessent himself refrains from directly endorsing Powell’s dismissal—a measure frequently floated by Trump—but his critique conveys implicit endorsement for a policy pivot sooner rather than later.

Balancing Independence vs Accountability

Bessent’s call for evaluation of the Fed does highlight a larger debate within governance—how to balance appropriate checks and oversight without compromising institutional independence. While designed as a non-political entity, the Fed’s influence over interest rates and broader economic policies necessitates dialogues on its adaptability over time.

Yet independence remains the cornerstone of trust investors have when navigating otherwise turbulent market climates. Compromising autonomy without clear frameworks risks overwhelming the body with shifting political agendas—a scenario that could cause market instability or appear incongruous under global scrutiny. Therefore Bessent’s assertions must be reconciled with robust considerations prioritizing balance and sustainable policy applications.

Conclusion: Towards a More Dynamic Monetary System

In moving forward pragmatically, open criticism of the Fed such as Bessent’s must be contextualized within broader economic discourse. Expecting zero recalibrations of monetary frameworks over time under dynamic circumstances may itself constitute institutional oversight. Nonetheless, such critiques also underscore the dangers team-driven rhetoric as evidenced during pointed exchanges between the administration, critics, & Fed functioning public-undercuts trust perceptions pivotal operating-centered global-financial-construct.net.Truly-global

Commentary

Questioning Independence of the Federal Reserve

The Federal Reserve’s reputation as an independent institution tasked with formulating monetary policy has come under scrutiny with the recent remarks by US Treasury Secretary Scott Bessent. While the independence of the Fed has historically been defended as essential for unbiased economic management, Bessent’s critique of its efficiency reflects growing concerns about its relevance and adaptability to current challenges.

There is no doubt that economic conditions today are vastly different from those a decade ago. Globalization, trade wars, and technological advancements have redefined the nature of fiscal and monetary dynamics. Yet, the Fed appears to cling to approaches that may not align with this changing landscape. Bessent’s suggestion of a review forces us to consider whether the Fed needs to evolve or risk losing its effectiveness.

The Trump Administration Taking a Sharp Stance

Bessent’s remarks should also be examined within the broader context of the Trump administration’s relationship with the Federal Reserve. Under President Trump, economic policies have sought to spur growth rapidly, often prioritizing short-term gains over long-term stability. While the Fed’s cautious approach may seem at odds with these goals, it serves as a reminder of its role as a stabilizing force. By advocating for an institutional review, however, Bessent hints that such conservatism may be stifling growth opportunities, particularly in an era of trade disputes and global competition.

A Delicate Balance Is Needed

Finding the right balance between independence and accountability is essential for the Federal Reserve’s future role. While the institution must continue to resist short-term political pressures, it should also remain open to introspection and modernization. Bessent’s comments serve as a wake-up call to strike this delicate balance, lest the Fed risks both its independence and effectiveness in steering the US economy through the 21st century.