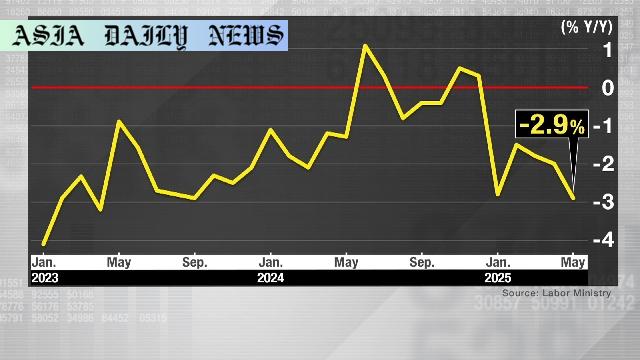

Real Wages: Japan sees a 2.9% decline in inflation-adjusted pay, marking the sharpest drop since September 2023 amid soaring inflation.

- Real wages in Japan decreased by 2.9% year-on-year in May 2023, marking the sharpest fall since September 2023.

- Despite a marginal rise in nominal pay, inflation continuously outpaced wage increases, leading to reduced purchasing power.

- May marked the fifth straight month of decline in real pay as Japan’s inflation rate topped 3% for six consecutive months.

Japan’s Real Wages Face a Multi-Year Setback

Japan’s economy has made headlines yet again, this time due to a significant drop in real wages for workers. Based on preliminary data from Japan’s labor ministry, inflation-adjusted wages fell by 2.9% in May 2023 compared to the same month a year earlier. This is the sharpest decline witnessed since September 2023 and signals troubling times for workers as inflation continues to erode purchasing power.

While nominal pay, including base and overtime wages, increased by 1% year-on-year to 300,141 yen (approximately 2,070 USD), this rise was insufficient to offset the surging inflation. Japan’s inflation rate has sustained levels above 3% for six consecutive months, creating a challenging economic environment where wage growth simply cannot keep pace with the increased cost of living.

Base Pay Provides a Silver Lining—But It’s Not Enough

Interestingly, base pay has shown consistent growth, increasing by 2.1% year-on-year to 268,177 yen (about 1,850 USD). This marks the 43rd straight month of gains in base salary, offering a small positive amidst the otherwise bleak economic scenario. However, even with this increase, workers’ overall income continues to lag due to the rapid rise in consumer prices.

The disparity between wage growth and inflation highlights a broader economic problem facing Japan. Despite efforts to boost incomes, many households are finding it increasingly difficult to maintain their standard of living as essential goods and services become costlier. This indicates a strong need for structural economic policies aimed at tightening the gap between wages and inflation.

The Broader Impacts of Declining Real Wages

The sustained decline in real wages has far-reaching implications for Japan’s economy. When workers’ purchasing power diminishes, their ability to spend and contribute to economic activities is equally reduced. This slowdown in consumer spending can create a ripple effect, eventually impacting businesses and GDP growth.

Additionally, persistent high inflation can erode public confidence in the central bank’s monetary strategy. Japan’s government and financial policymakers may need to re-evaluate their existing measures to combat inflation while supporting wage growth. Failure to balance these elements may lead to continued economic stagnation in one of the world’s largest economies.

What Can Japan Do to Address Wage-Inflation Disparities?

Solving the disparity between real wages and inflation calls for a multi-pronged approach. Firstly, ensuring consistent wage increases that outpace inflation is crucial. Policymakers must collaborate with industries to implement wage frameworks that enable higher income growth for workers, particularly in sectors hit hardest by inflationary pressures.

Secondly, addressing cost-of-living concerns through subsidies or tax-relief packages could temporarily alleviate the financial burden on households. Additionally, strengthening Japan’s overall economic resilience by investing in innovation, productivity, and labor market reforms is critical for sustainable growth. By focusing on long-term measures, Japan can hope to create an equitable economic system where wage growth aligns with or exceeds inflationary trends.

Commentary

Understanding the Wage-Inflation Conundrum

The statistics coming out of Japan paint a vivid picture of the challenges faced by its working population. While nominal wages have seen consistent growth over the last 43 months, surging inflation negates much of the progress made. This disconnect between income and inflation underscores a critical fault line in Japan’s otherwise robust economy.

The Real Impact on the Workforce

It is impossible to overlook the day-to-day struggles that these statistics signify. For the average worker, a 2.9% drop in real wages translates to reduced purchasing power, making everything from groceries to housing more expensive. Tackling these issues requires not just incremental wage adjustments but systemic improvements in economic structures that support households during inflationary surges.

The Role Policymakers Must Play

Japan’s policymakers face an unenviable challenge: balancing inflation control with boosting wages. Without immediate intervention, continued economic dissatisfaction among workers could influence broader areas such as productivity and investment. Effective policy formulation that addresses the core issues of wage stagnation and rising living costs is paramount for long-term stability.