Jerome Powell: Trump demands the immediate resignation of Federal Reserve Chair amid ongoing criticism and investigation calls.

- Trump has demanded the resignation of Federal Reserve Chair Jerome Powell.

- The call comes amid criticism of Powell’s stance on interest rates.

- The dispute escalates due to Powell’s cautious approach to rate changes.

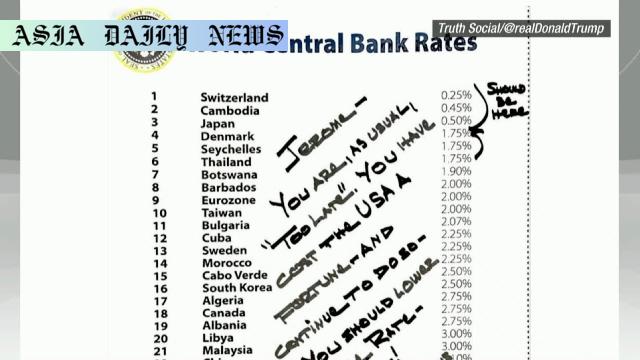

- Trump has attempted to publicly pressure Powell with comparisons to other central banks.

- An investigation into Powell’s Senate testimony has also been suggested by federal regulators.

Escalating Tensions Between Trump and Jerome Powell

The relationship between former President Donald Trump and Federal Reserve Chair Jerome Powell has once again come under scrutiny. Trump has publicly demanded Powell’s immediate resignation, intensifying a conflict that has been simmering since Powell assumed office. The latest call for resignation stems from Trump’s discontent with the Fed’s monetary policies, particularly Powell’s cautious stance on lowering interest rates. Trump’s frustration with Powell has been an ongoing theme, as the former president views the Fed’s hesitation to rapidly cut rates as a hindrance to economic growth.

This controversy gained further momentum after Trump shared an article referencing a federal regulator’s suggestion to investigate Powell’s Senate testimony. Such public pressure highlights not only Trump’s dissatisfaction but also the politicized environment surrounding economic policy. Trump’s social media posts provide insight into his growing impatience, as he reiterated that Powell has been repeatedly “too late” in his approach to monetary adjustments. The demand for Powell’s resignation is not an isolated incident but rather part of a broader critique of the Federal Reserve’s approach during Trump’s administration.

Economic Background and Powell’s Position

Jerome Powell, known for his measured and data-driven approach, has consistently advocated for caution when altering the Fed’s monetary policy. According to Powell’s previous statements, making abrupt changes can destabilize the economy, particularly in the context of Trump’s tariff measures and international trade uncertainties. However, Trump and his administration have argued for immediate action, comparing the U.S. Central Bank’s rates to those of other nations. This differing perspective on economic management underscores a deep divide in strategy, with Trump favoring aggressive policies aimed at boosting growth while Powell prioritizes economic stability and risk management.

Powell’s handling of interest rates has also sparked debates within and outside the administration. Trump’s approach to criticizing Powell raises important questions regarding the independence of institutions like the Federal Reserve. Many economic experts have voiced concerns about the potential repercussions of politicizing monetary policies, emphasizing the importance of maintaining the Fed’s autonomy. Powell’s critics within the Trump administration, however, continue to push for policies they believe align with more immediate economic growth objectives.

The Broader Political and Economic Implications

The renewed scrutiny of Jerome Powell by Trump could set a concerning precedent for how future presidents interact with central banking authorities. The Federal Reserve has long been considered an institution separate from political interference, tasked with balancing inflation and unemployment through monetary tools. Trump’s repeated interventions and public calls for Powell’s resignation risk undermining this independence, potentially eroding trust in the Fed and its ability to make impartial decisions for the nation’s financial health.

On a global scale, the tension between Trump and Powell may also reflect broader challenges to central banks worldwide. As economies grapple with uncertainties such as trade wars and post-pandemic recoveries, leaders may seek quick fixes in hopes of achieving impactful results. However, it is crucial to acknowledge the value of cautious decision-making in preserving financial stability, especially in volatile conditions. Powell’s reluctance to lower interest rates without assessing the broader impact echoes sentiments shared by other central banks, many of which face similar pressures from political leaders seeking rapid economic solutions.

The Path Forward: Resolving the Rift

For Jerome Powell, maintaining the Federal Reserve’s authority while navigating criticism from figures like Trump will require resilience and transparency. As calls for an investigation into his Senate testimony arise, Powell may need to address these claims directly to restore public confidence. It also falls upon policymakers and economic advisors to bridge the gap between differing perspectives on managing the nation’s economy. While Trump’s frustrations are understandable from a growth-focused viewpoint, Powell’s measured strategy remains essential for guarding against potential negative consequences of rushed monetary changes.

Ultimately, resolving these disagreements will not only benefit the U.S. economy but also reestablish trust in institutions like the Federal Reserve. By fostering dialogue and understanding, leaders on all sides can work collaboratively to address pressing economic challenges without undermining the integrity of key national institutions.

Commentary

The Complex Dynamic Between Leadership and Economic Policy

The ongoing debate between former President Donald Trump and Federal Reserve Chair Jerome Powell underscores an essential tension in modern governance. Leaders like Trump, who prioritize swift and impactful policies, often clash with cautious technocrats like Powell, who are mindful of long-term ramifications. This clash of approaches presents significant challenges, as both perspectives carry merit within their respective contexts. Trump’s call for immediate action reflects the urgency of achieving economic growth, particularly during times of volatility caused by trade wars or other factors. However, Powell’s caution serves as a reminder of the pitfalls that can arise from hasty decision-making in complex financial systems.

The Importance of Independent Institutions

One of the most critical aspects of this dispute is the broader question of institutional autonomy. The Federal Reserve’s independence is a cornerstone of America’s economic framework, and any perception that it is influenced by political agendas could jeopardize its credibility. Trump’s repeated public criticisms of Powell highlight the need to strike a balance between political oversight and autonomous decision-making within institutions. While leaders have every right to challenge policies and advocate for their vision, preserving the Fed’s role as an impartial entity is crucial for long-term stability.

Moving Toward Constructive Dialogue

Ultimately, solving disagreements like the one between Trump and Powell requires constructive dialogue and mutual respect. Both sides must acknowledge the complexities of monetary policy and consider collaborative solutions rather than engaging in public disputes. For critics of Powell’s strategies, understanding the broader implications of monetary policy choices should be a priority. Likewise, Powell must recognize the pressures faced by political leaders who are striving for immediate results. By fostering a culture of communication and cooperation, policymakers can address economic issues more effectively without undermining key institutions or their leaders.