Middle East tensions cause Nikkei 225 to fall and oil prices to rise.

How Escalating Middle East Tensions Impact the Economy

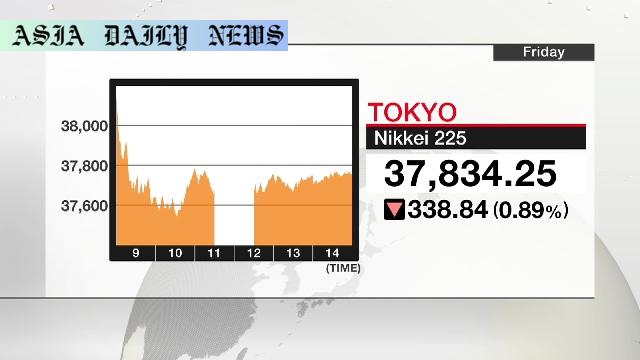

Nikkei 225 Suffers Amid Geopolitical Concerns

The bombshell news of Israel’s military strikes on Iran sent shockwaves across global markets on Friday. Japan’s benchmark stock index, the Nikkei 225, felt the tremors sharply, closing down by 0.9% at 37,834. The timing of the strike coincided with markets opening, triggering an immediate risk-off sentiment among investors. This downward movement underscores the market’s sensitivity to sudden geopolitical upheavals, particularly those that involve critical regions like the Middle East.

Analysts are raising alarm bells, warning that continued tensions might spiral into economic disruptions on a global scale. Investors in Japan and abroad are carefully weighing their positions, mindful of the financial instability that could follow prolonged conflict. The quick selloff observed in the Nikkei also reflects a broader trend, as markets remain tightly interconnected and vulnerable to external geopolitical risks.

Crude Oil Prices Spike to Nine-Month High

The global oil market has not remained untouched by the unfolding crisis. West Texas Intermediate (WTI) crude oil futures climbed to $74 per barrel on Thursday—marking the highest level since January. Just hours before the military strike was reported, crude was trading in the $68 range, highlighting the immediate reaction to concerns about supply disruption.

At the heart of these rising prices lies the Strait of Hormuz, a critical artery for global oil transport. As much as 20% of the world’s crude passes through this narrow waterway linking the Persian Gulf to the Arabian Sea. With the potential for increased instability in the region, traders are anticipating tightening crude supplies, which could have far-reaching consequences for industries reliant on energy resources.

Long-Term Implications for the Global Economy

The ramifications of a sustained Middle East conflict could extend far beyond short-term spikes in oil prices or dips in stock indices. A prolonged military engagement in the region risks sparking a host of economic challenges, including inflationary pressures driven by soaring energy costs. Industries globally would face higher operating expenses, which could be passed on to consumers.

Additionally, governments might find themselves grappling with policy challenges as they navigate these rising costs while attempting to stabilize their respective economies. Central banks, in particular, could face significant pressure to adjust monetary policies in response to the crisis. The economic ripples might disrupt global trade flows, exacerbate supply chain constraints, and heighten geopolitical uncertainties, leaving lasting scars on the financial landscape.

The Path Forward: Risks and Opportunities

While the immediate outlook appears bleak, the situation presents opportunities for industries and governments to prioritize energy diversification. Renewable energy sources and alternative technologies may gain greater focus as economies look to reduce dependence on geopolitically sensitive oil supplies. Furthermore, international bodies might step up to mediate tensions in the Middle East, aiming for a de-escalation of hostilities and a stabilization of the global economic environment.

For investors, this period serves as a critical reminder of the importance of diversification and risk management. While market volatility remains a challenge, proactive strategies could mitigate losses and create pathways to long-term gains.

Commentary

Commentary on Escalating Middle East Tensions

The Fragile Balance of Global Markets

The events in the Middle East underscore just how interconnected and fragile the global economy truly is. The Nikkei 225’s 0.9% drop in response to geopolitical tensions serves as a potent reminder of how unforeseen events can ripple across financial ecosystems thousands of miles away. The market volatility driven by the strikes on Iran reflects the pervasive uncertainty that investors face when world events seem out of their control.

Oil Prices: A Double-Edged Sword

The surge in oil prices, while understandable given the circumstances, highlights a precarious dependency on Middle Eastern oil supplies. It’s a stark reminder of the fact that despite advancements in alternative energy sources, the global economy still leans heavily on fossil fuels. This reliance not only leaves economies vulnerable to price shocks but also underscores the urgent need for energy policy reforms centered on sustainability.

A Call for Stability and Diplomacy

Beyond the economic implications, the strikes and the ensuing tensions emphasize the dire need for stability in the Middle East. The international community must explore pathways for diplomacy and conflict resolution. Governments and institutions around the globe should treat these escalating tensions as an opportunity to reaffirm their commitments to peaceful dialogue.

Final Thoughts

While the news of the strikes is worrying, it also serves as a wake-up call. It’s a moment for global leaders, corporations, and individuals to reflect on their susceptibility to geopolitical instability. Whether through diversifying investments, reducing energy dependency, or advocating for peace, there are steps we can all take to navigate these turbulent times.