US Credit Rating: Treasury Secretary Bessent dismisses Moody’s downgrade, emphasizing investor confidence amidst a strong market.

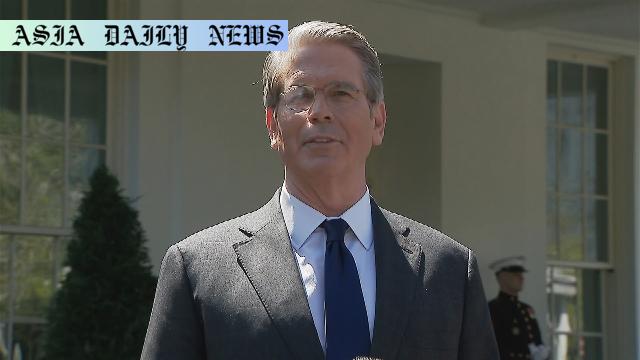

- Treasury Secretary Scott Bessent dismissed Moody’s downgrade of the US credit rating from Aaa to Aa1.

- Bessent emphasized strong investor confidence, with trillions flowing into the US economy.

- He highlighted that market factors leading to the downgrade are already priced in and noted ongoing trade negotiations.

Introduction: What Happened?

The recent downgrade of the US sovereign credit rating by Moody’s Investors Service has sparked significant debate among economic experts and policymakers. The credit rating was reduced by one notch, moving from the highest rating of Aaa to Aa1. Moody’s justified their decision by highlighting concerns over rising government debt levels and increasing interest payments. However, US Treasury Secretary Scott Bessent has openly rejected the implications of this downgrade, choosing instead to focus on indicators that reveal investor confidence and a strong economic foundation.

Bessent’s Response to the Downgrade

Speaking during an interview, Bessent expressed skepticism about the relevance of the downgrade, stating that he does not place much “credence in Moody’s” assessment. He emphasized that global investors are continuing to pour trillions of dollars into the US market, which reflects strong confidence in the nation’s economic performance. According to Bessent, the reasoning behind the downgrade—such as rising debt and interest payments—has already been factored into the markets. In his words, “the history of rating agencies [is such that], by the time they get to a downgrade, everything’s already in the market.” This statement underscores his perspective that the downgrade is a lagging indicator rather than a leading economic concern.

Investor Confidence in the US Economy

Despite the downgrade, the US continues to hold one of the most attractive markets globally. The inflow of trillions of dollars into the economy suggests that investors remain optimistic about the long-term stability and growth potential of the US. This confidence is often reinforced by the nation’s robust financial system, diverse industrial base, and status as a global economic leader. Bessent’s comments further underline the US government’s efforts to maintain stability, even amid challenges such as debt management and tariff negotiations.

Trade Relations and Economic Strategy

In addition to addressing the credit rating issue, Bessent shed light on the US government’s broader economic strategy. He mentioned that the administration is actively working on regional trade deals, with examples including agreements for Central America and parts of Africa. These agreements are aimed at strengthening economic ties while ensuring mutual benefits for all parties involved. Bessent also highlighted the focus on 18 key trading relationships, indicating that despite the challenges posed by previous tariff policies, the administration is committed to fostering collaborative partnerships globally.

Conclusion: Beyond the Downgrade

While the Moody’s downgrade may raise concerns in some circles, the broader picture suggests a resilient and adaptive US economy. Bessent’s dismissal of the downgrade reflects a confidence that is mirrored by investors worldwide. As the US continues to navigate complex issues such as trade negotiations and debt management, its leadership remains focused on ensuring sustained growth and stability. For now, the downgrade serves as a reminder of the challenges faced but does not define the trajectory of the world’s largest economy.

Commentary

Understanding Moody’s Downgrade

The downgrade of the US credit rating by Moody’s has sparked conversations across the financial world. While the decision may seem significant, it is crucial to understand the reasoning behind it and its potential implications. Moody’s cited rising debt levels and increasing interest payments as the primary factors, highlighting long-term concerns about fiscal sustainability. However, such downgrades are often backward-looking and serve as a reflection of decisions already made rather than an indicator of future performance.

Bessent’s Optimism: A Justified Stance?

US Treasury Secretary Scott Bessent’s dismissal of the downgrade offers an alternative perspective. His emphasis on strong investor confidence, evidenced by the inflow of trillions of dollars into the US economy, is supported by market trends. The US remains a global powerhouse, attracting investments due to its stability, innovation, and economic resilience. While it is essential to address areas of concern, such as rising debt, Bessent’s optimism may reflect the broader economic reality better than Moody’s analysis does.

What This Means for the Future

Looking forward, the US government must balance short-term policies with long-term sustainability. This includes managing debt effectively, fostering strategic trade relationships, and maintaining an investor-friendly environment. While downgrades by agencies like Moody’s should not be dismissed entirely, they must be weighed against broader economic indicators and trends. Ultimately, the US’s economic future depends on its ability to adapt, innovate, and lead on the global stage.