Sumitomo Mitsui to acquire 20% of Yes Bank, marking its first investment in an Indian commercial bank.

Sumitomo Mitsui acquires a 20% stake in Yes Bank for $1.5 billion.

The deal marks its first investment in India’s commercial banking sector.

This move aims to boost services for SMEs and individuals in India.

The acquisition aligns with their strategy to expand in Asian markets.

India’s population and fast-growing economy are key attractions.

Introduction: Sumitomo Mitsui’s Strategic Investment

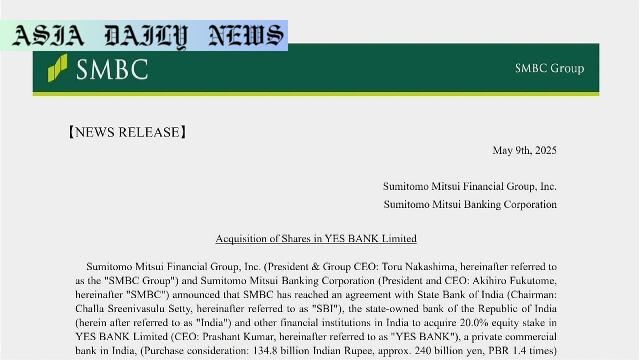

Japan’s Sumitomo Mitsui Financial Group is making headlines with its strategic acquisition of a 20% stake in Mumbai-based Yes Bank for approximately 135 billion Indian rupees, equivalent to $1.5 billion. This bold move underscores Japan’s financial giant’s aspirations to penetrate the burgeoning Indian market and capitalize on its immense potential.

Why India? Unlocking Growth Potential

India, with its population surpassing 1.4 billion, represents one of the world’s largest and fastest-growing economies. Sumitomo Mitsui recognizes this unparalleled market opportunity as a significant springboard for its expansion. By partnering with Yes Bank, a company established in 2003 and boasting over 1,200 branches across India, the Japanese conglomerate aims to enhance its offerings, particularly for small and medium-sized enterprises (SMEs) and individual banking customers. India’s massive consumer base and its evolving financial services landscape present an ideal avenue for growth.

Strategic Diversification Amid Global Challenges

This deal doesn’t just signify growth; it’s also a strategic approach to mitigating global economic risks. With economic uncertainty arising from US tariff policies and other geopolitical trends, Sumitomo Mitsui’s investment in India’s commercial banking sector strategically diversifies its portfolio. India joins other emerging markets such as Indonesia, Vietnam, and the Philippines, where the Japanese financial giant has already established a presence.

Impact on India’s SME and Individual Banking

The collaboration between Sumitomo Mitsui and Yes Bank is expected to yield significant benefits for India’s SMEs and retail banking sector. This partnership will enable the two institutions to enhance service offerings in terms of accessibility, digitalization, and innovative financial products. It’s a mutually beneficial arrangement, positioning Sumitomo Mitsui as a key player in shaping India’s banking future while helping Yes Bank leverage Japanese expertise and investment.

A Broader Vision: Expansion in Asia

Sumitomo Mitsui’s decision to enter India aligns with its broader strategy of consolidating its presence in emerging Asian economies. By acquiring non-banking financing companies and investing in commercial banks across Indonesia, Vietnam, and the Philippines, the group aims to establish itself as a pan-Asian financial powerhouse. The Indian expansion is not an isolated move but part of a carefully orchestrated plan to dominate Asia’s financial ecosystem.

Conclusion: A Win-Win Scenario

In summary, Sumitomo Mitsui’s $1.5 billion investment in Yes Bank signals a significant step in the financial group’s ambition to expand its geographical and market reach. This strategic move offers benefits not only for the Japanese financial conglomerate but also for India’s banking sector, particularly SMEs and individual banking customers. It further diversifies the company’s portfolio amid a shifting global economy and cements its role in the evolving financial landscape of Asia. The future is bright for Sumitomo Mitsui and Yes Bank, with the partnership poised to unlock a new chapter of growth and innovation.

Commentary

The Strategic Importance of Sumitomo Mitsui’s Move

Sumitomo Mitsui’s decision to invest in Yes Bank is a landmark event for the company and for India’s financial sector. This move not only demonstrates the growing allure of India as a key destination for international investments but also highlights the Japanese financial giant’s calculated approach to expand its global footprint. The focus on serving SMEs and individual customers indicates that Sumitomo Mitsui sees immense untapped potential in India’s retail banking and business finance sectors.

India: A Financial Frontier

India’s appeal as an investment destination is clear. Its burgeoning economy, youthful population, and increasing financial inclusion efforts make it ripe for disruption and development. Sumitomo Mitsui’s partnership with Yes Bank provides a strategic foothold in this rapidly growing market. Moreover, this collaboration signifies a shift in India’s financial landscape, opening doors for other foreign players to consider similar investments. The modern banking needs of India’s vast population align perfectly with Sumitomo Mitsui’s global expertise and resources.

Global Strategy at Play

The investment in Yes Bank is not an isolated event but a cog in the wheel of Sumitomo Mitsui’s broader strategy to dominate emerging markets in Asia. The financial giant’s ventures in regions like Indonesia, Vietnam, and the Philippines reinforce their commitment to unlocking growth across the continent. By diversifying their investments geographically, Sumitomo Mitsui not only mitigates risks from global economic uncertainties but also positions itself at the forefront of financial innovation and expansion in Asia.

Looking Ahead

Overall, the partnership between Sumitomo Mitsui and Yes Bank is a noteworthy development in the global banking sector. It marks a win-win scenario where Yes Bank receives the much-needed financial infusion and expertise, while Sumitomo Mitsui unlocks a new market full of opportunities. As this deal unfolds, it is likely to inspire confidence among other foreign investors, further solidifying India’s reputation as a global financial hotspot. The future looks promising for both partners and for India’s growing financial ecosystem.